While you were sleeping, Venezuela went Weimar

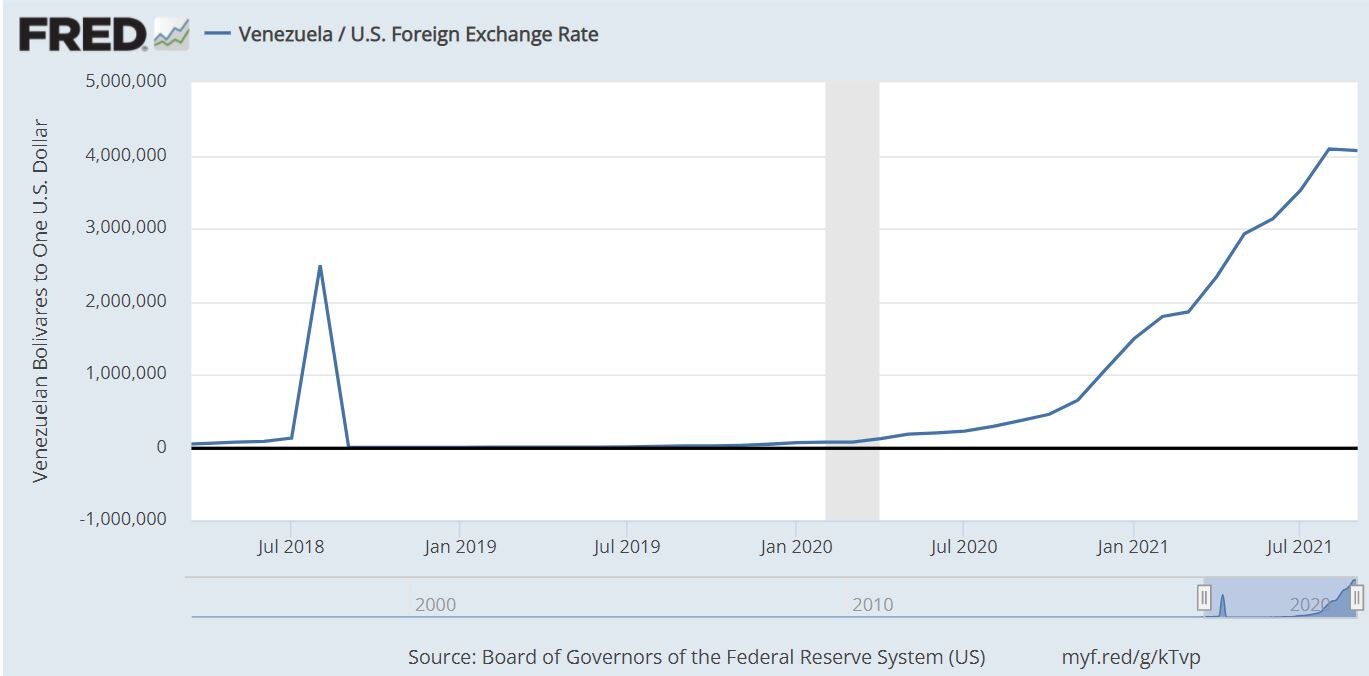

This is what hyperinflation looks like.

While we’ve been focused on COVID, shipping containers and the biffo between China and the rest of the world, Venezuela’s gone Weimar Republic.

On 1 September 2017, it only took 9.75 Venezuelan Bolivars to buy one U.S dollar.

On 1 September 2021, it took 4,063,529 Bolivars jammed into a cart with four horses dragging it, to buy one U.S dollar.

Don’t adjust your set, just check this out 👇👇👇👇

Using the U.S dollar as the denominator, the Bolivar has weakened by 2426% per annum for the past four years.

For this rate to occur, prices would probably need to change on a daily basis, and some times more than once.

According to FRED data, the causes are:

83% decrease in productivity (production/cost + labour input) since 1970

Material loss of population in the last decade

Of those left, labour force participation rate of less than 50%

40% drop in cellular subscriptions

70% decline in GDP over the past decade

Virtually, no economy to speak of

It’s like a galactic superweapon had been blasting Venezuela for four years, non-stop.

But think for a moment - what happens in stronger countries if supply chains stay bottlenecked for extended periods, and under-investment in supply due to COVID effects eventually stifles demand?

Productivity drops, commodity prices and inputs skyrocket (there’s a rotation into commodities and materials stocks), and then GDP drops again and if left unchecked, inflation goes berserk.

While the big five central banks see it as an opportunity to inflate away their debt, there’s a risk inflation overshoots a level that might be seen to be comfortably transitory.

Unfortunately, central bank digital currencies won’t work in these scenarios because all they will do is digitalise an already rubbish currency.

But, allowing citizens to convert barbequed Bolivars into fractionalised Bitcoin and other stores of value before it’s too late, should be encouraged by governments, central banks and the IMF (which should each convert their reserves into Bitcoin if they’re worried about capital flows).

See you in the market.

Mike

Next Level Corporate Advisory is a leading M&A and capital markets advisor with a 20 year track record of delivering the highest quality of independent financial advice as well as strategic transactions to help our clients level-up.

All text in this article is copyright NextLevelCorporate.