Boom! Nearly 1 million new jobs, so is the USD wrecking ball coming?

Wrecking Ball Tour.

The USD wrecking ball?

Yup, the idea that if sustainable growth is real and inflation comes with it (reflation), US yields go up and so too does the USD, causing problems for people and businesses in weaker currency countries.

For some, it makes it more expensive to purchase USD to trade, invest, transact and service USD denominated debt – with one effect being that capital blasts out of emerging markets into higher yielding dollars, as the wrecking ball ploughs through the comparatively weaker currency.

Without synchronous growth and inflation, these weaker players are unable to inflate away their debts, putting them firmly in the shadow of the dollar wrecking ball.

It’s different for us here in Australia because a strong USD against a stable or falling AUD means that our US dollar denominated commodity exports get a turbocharge.

That is, not only are export volumes rising, but we get a double dip through more AUD exchanged for each USD received. And, the additional benefit that flows into Australian hands is especially important because each time we have a commodities boom, we experience higher domestic costs due to labour shortages and increasing labour rates.

But we have a ~$50 billion trade surplus - whereas for countries with a trade deficit it can be a very different story, particularly where they are behind the U.S. in terms of the reopening curve, and growth/inflation expectations.

A well designed plan will be required to avoid getting crushed.

So, today I’ve put down some thoughts on the dollar wrecking ball, it’s potential causes and effects, and its winners and losers, with some inspiration from the Boss.

Here’s what’s been rising of late.

Lots of good news and expectations for the reopening in the U.S. has caused the rising.

U.S. non-farm payroll employment rose by 916,000 in March, nearly double that of February.

NLC chart extrapolation from US BLS.

…….while the unemployment rate edged down to 6.0 percent.

This was helped by vaccinations, which as of 1 April hit a new level of 3.5m per day.

Source: US CDC.

According to the New York Times, it appears that nearly 1/3rd of the population in the U.S. has received at least one shot.

That’s more than in any other large country on a per capita basis, other than for the UK. That said, Israel leads.

Canada and continental Europe are far behind and Australia, Brazil, China, India and Russia have been even slower.

On the other hand, new cases in the U.S. are on the increase, and back on par with one month ago, with an increasing 7 day moving average which is a bit of a worry.

Source: US CDC.

But thankfully, the death rate is going down, down, down, down, down…….

And, while U.S. CPI is still below 2% with February printing 1.7% annualised, food printed 3.6% and energy 2.4%, which makes sense given shortages, weather conditions and pent-up demand.

Until supply and distribution chains are returned to normal (and some never will), this may persist for some time - pushing up inflation, yields and the USD.

The 10 year bond yield has been rising (to 1.732%) as bond vigilantes have railed against the Fed at the mid and longer end of the curve.

And as U.S. yields have been rising, the USD has strengthened against the Euro. This makes sense given U.S. leadership on vaccinations and COVID management, versus the shambolic experience in Europe.

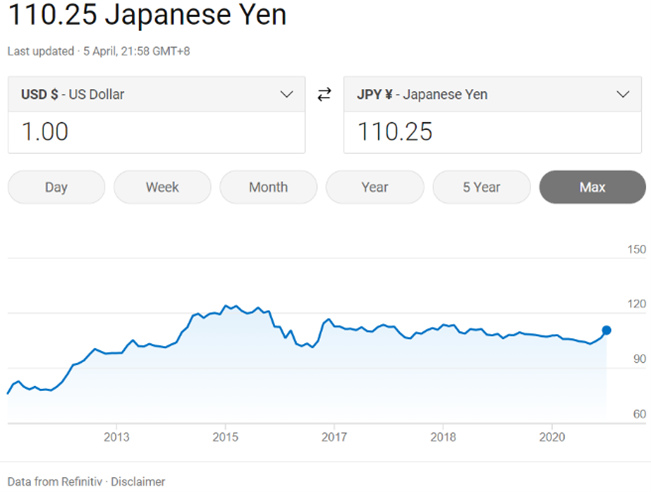

……..and it’s also strengthened against the safe haven Yen, which says a lot.

And when we look at emerging markets like Brazil, the wrecking ball shadow can be seen, large and low.

Even in Indonesia the exchange is edging back up to the 15,000 level, and given the decimated Indonesian tourism industry and difficulties experienced with its last reverse repo auction that failed to even get to 20% of the ask, further strengthening could create problems for that sovereign.

Such is the power of the world’s reserve currency when bond yields or dollar demand from growth (including expectations) rise. Great if you can inflate away your debt, but not so good for others countries that are out of synch with lockdowns, instead of re-openings.

And despite the AUD strengthening as a result of unprecedented commodities demand, the USD has started to strengthen against the AUD, since late February. It’s no more than a 5% move (the tiny kick below the blue dot) and it may reverse if the AUD strengthens as a result of the next leg up in commodity prices, but while Aussie rates stay at all time lows, any runaway growth in the AUD is unlikely.

As for the interest rate scenario here in Australia, yesterday the RBA decided to keep monetary policy ‘as is’ with lower rates for longer and yield curve control.

The central bank says there’s way too much slack in the labour force to think about any changes:

“Nevertheless, wage and price pressures are subdued and are expected to remain so for some years. The economy is operating with considerable spare capacity and unemployment is still too high. It will take some time to reduce this spare capacity and for the labour market to be tight enough to generate wage increases that are consistent with achieving the inflation target. In the short term, CPI inflation is expected to rise temporarily because of the reversal of some COVID-19-related price reductions. Looking through this, underlying inflation is expected to remain below 2 per cent over the next few years.”

“The Board is committed to maintaining highly supportive monetary conditions until its goals are achieved. The Board will not increase the cash rate until actual inflation is sustainably within the 2 to 3 per cent target range. For this to occur, wages growth will have to be materially higher than it is currently. This will require significant gains in employment and a return to a tight labour market. The Board does not expect these conditions to be met until 2024 at the earliest.” RBA 6 April 2021

It sees inflation as sporadic and temporary with not so much as a whimper before 2024.

That could get quite boring.

It will also be interesting to see how retail fares after JobKeeper ended yesterday.

However, it’s consistent with the U.S. Federal Reserve’s view, until it’s not.

Will the USD continue to rise?

We are waiting to see if the increase in US bond yields will continue to push the USD up, and if so whether the rise is being inspired by bond vigilantes wanting a reward for expected inflation (which may or may not be there) or perhaps its real economy growth due to increasing vaccination counts and the great reopening.

But let’s just remember that the real economy wasn’t so hot coming into COVID, even though the secondary markets (equities and bonds) had reached all-time highs.

That was more a function of incredible flows into equities, tax cuts and Jerome Powell backflipping on the normalisation trajectory in January 2019.

Yesterday, the 10 year was at a level of around 1.73%. Still low. And perhaps it might need to be at at 2.5% - 3% before the cost of money becomes too much of a tax on USD debtors that need to service and/or refinance maturing debt at higher interest rates?

And if they do go up, we still don’t know whether the Fed will intervene with the very rarely travelled path of yield curve control, or the more acceptable Operation Twist that was used during the GFC.

That is, maximum purchases at any price, versus selling short term treasuries to buy long term bonds, with no net increase.

What are secondary markets saying?

Equities are not a great predictor of what might happen here.

Movements in share prices and indices are more about sentiment and animal spirits. They’re going up which suggests equities folk believe the future looks bright and they see an increase in bond yields as consistent with their growth expectations. Inflation expectations are getting baked in.

Still, it’s been interesting and sometimes even confusing to watch the rotation of equity investment from unprofitable growth stocks to value and cyclical stocks, i.e., banks, insurers, industrial companies, hospitality, airports and tourism style stocks that do well in a growth environment (post-lockdowns).

This trade started when the vaccines were announced last November, but more recently the rotation has been quite variable.

Does that mean certain elements of the equities market are questioning whether what they are seeing is really sporadic inflation, instead of reflation?

Put another way, is the increase in prices due to pent-up demand and supply shocks (wrecking ball shadow), or increases in real economic growth in the American land (wrecking ball impact in non-synchronous growth countries)?

Maybe.

For the moment though, neither the treasuries yield curve, most of which is fake due to manipulation by the Fed, nor the equities market with its variable rotation from value to certain growth stocks, are accurate barometers.

The VIX tells us nothing. It tracks S&P500 options volatility but this is now affected by the disproportionately high use of options by the Reddit Army, Wall Street Bets, hedge funds and others in that trade, so it’s no longer a predictor of fear, rather, it’s an indicator of establishment greed pitted against reddit revenge, with each group taking care of their own across short and long squeeze cycles.

The acquiescence of the gold price is probably a function of profit taking and switching into Bitcoin, so we can’t draw too many conclusions from that either.

However as greater quantities of assets continue to be bid up and more dollars are needed to transact, the wrecking ball remains suspended in clear view despite the Fed’s dovish stance.

USD rising, but lots of financing risk.

There are some defences to the dollar wrecking ball scenario, and they are:

The Fed increasing USD swap lines like in April, which as I’ve said before is actually a debt obligation, in USD!

Rate cuts/yield management over and above providing sufficient liquidity to keep the banking sector operating smoothly, i.e., easy money

A reversal of progress in fighting COVID/opening the U.S. economy as a result of worrying new coronavirus strains and/or other countries catching up with the U.S.

The twin deficits, budget deficit, $3.2 trillion and trade deficit, $0.9 trillion.

In other words, there are a few factors that could challenge the strength of the recovery/reopening, and in turn express themselves in the currency.

Biden’s next $2 trillion to $3 trillion fiscal stimulus will be spent on America's thunder roads, bridges, water systems and electricity grid, which will require a significant amount of commodities to deliver on.

If that jack of all trades package passes there will be more of a pull on commodities and the labour market - but how will it be funded?

Add to that bill a portion of the $162 trillion of unfunded liabilities, much of which will be required to be expended on the shackled and drawn baby boomer cohort - and you can see a massive funding shortfall.

That brings with it a shedload of potential for the USD to be overprinted and diluted just to keep up with the spending, and for gold and Bitcoin to go on another blaze, just like fire would. It also means the more ethereally high PE stocks run the risk of getting smashed.

Suffice to say there are some good reasons to suggest the wrecking ball will remain still and suspended, and other good reasons to suggest the ball could start to swing into certain non-synchronous growth countries, depending on how the U.S. Treasury and Fed decide to fund America’s reopening.

Avoiding the wreckage.

The most logical thought process is that in light of the twin deficits and the new stimulus bill, there will be more Treasury issuance.

But if the Fed is the only buyer due to low yields, its balance sheet will grow fatter, not thinner as it becomes the anchor buyer, further kicking the ball down the track.

One alternative is to let the market dictate yields - but that means higher interest rates and at a certain level, enter the dollar wrecking ball.

Another alternative which could also be used to solve some social inequality issues caused by QE Infinity, is tax hikes. Taxes may need to be part of the answer, which is probably what’s behind Treasury Secretary Yellen’s recent call for a minimum global tax rate for multinationals, no matter their location.

A daring and wistful plan. And, something that is in total opposition to the tax free kicks instituted by the Trump Administration. But tax leakage creates rocky ground and as Warren Buffet has said on the subject, ‘come and tax me, please’.

Coincidence? I don’t think so. Trump’s tax cuts poured rocked fuel on secondary markets but made America (cash inflows) weak and decades of tax leakage from foreign sourced income is a key reason for the size of the U.S. budget deficit.

Also, filling the banking system with liquidity (via QE Infinity) is a blunt instrument that does not get to the small businesses and households that need it, causing social inequality. Populist policies and taxes hikes on the wealthy, do. Enter the Democrats.

What we also know is that Treasurer Yellen has a long working relationship with Fed Chair Powell, and perhaps if they work together we might see a smart way forward for their great American land.

So - for the moment, most indicators point to a rising USD against a range of non-synchronous growth emerging market currencies in the short-term, and perhaps mid-term, with some risk of capital flows out of emerging markets and impending pain for those with too much USD denominated debt, and insufficient growth/inflation to inflate it away.

But thereafter, I expect to see some soft shoe shuffling around the twin deficits and the Fed’s plan to unravel its obese balance sheet, while Treasury seeks to fund up to $3 trillion of infrastructure spending - maybe with taxes and additional USD swap lines to cushion the wrecking ball effect in other countries.

Predictions?

Nope, just some final thoughts.

If Treasury signals more issuance, the ball bounces down the track again and when the Fed buys those bonds, it adds more freight to the QE Infinity train to nowhere, with all of its consequences that we’ve discussed many times before.

Whereas, if Treasury seeks to fund its working on the Green highway by raising taxes, and if the Fed gradually normalises earlier rather than later, then the U.S. dollar strengthens and squashes currencies in low growth countries still battling the virus and far from a recovery.

Plus, it smashes into the equities market (higher rates and taxes means higher debt servicing costs and lower corporate profits) as well as the bond market (rising yields means lower prices).

It would also threaten gold and bitcoin if there is reflation and real yields rise.

And while the U.S. economy starts to get great again and its debt obligations start to inflate away, we could on the other hand see a correction in equities and bonds, and carnage in other lockdown/laggard countries, where more currency is required to buy the same amount of USD.

I have high hopes that the dynamic duo of Yellen and Powell will come up with the right plan that balances a more prudent flow of monetary liquidity that can be normalised gradually, with new fiscal growth spending in a way that doesn’t turn into a dollar wrecking ball elsewhere.

As always, time will tell.

Best, Mike

Next Level Corporate Advisory is a leading M&A, capital markets and strategy advisor with a multi-decade track record of delivering high quality independent corporate advice and strategic transactions. We design, find and arrange transformative mergers, acquisitions, divestments, IPOs, growth financings and other corporate events that help our clients take their operational and corporate strategies to the next level, in and out of Australia.

All text in this article is copyright NextLevelCorporate.