Perky Bases Pesky Bulks in November

Image: Patrycja Grobelny

A quick update on the monthly rate of change for commodity prices that matter down under and contribute to export receipts/government surpluses.

I look at spot prices to see what’s happening because the incremental/marginal tonne (versus offtake pricing at volume) is more instructive on trend. I look at the SDR to remove Dollar Vader effects.

Bulks (iron ore and the coal complex)

The spot price in SDR for bulk commodities fell again in November.

More importantly the price slowed 50% faster in November than it did in October, i.e., the rate or speed of price decline increased even though October was a bigger reversal from September.

Again, given parts of the coal complex were up, it implies the pain was felt in iron ore. Share prices moved in tandem although some perked up end of month due to earnings season promotion.

Copyright NextLevelCorporate.

Declining bulk prices is a function of Putin, Xi’s zero-COVID policies and the deteriorating global demand for steel (hence iron ore and coking coal) despite a recent uptick in coking coal prices.

While there is speculation that property market stimulus will be announced in China at the Central Economic Work Conference (CEWC) on Thursday, we will need to wait to see if that occurs and whether the recent bullishness of a China reopening (and increased consumption and spending internally) will be justified/supported.

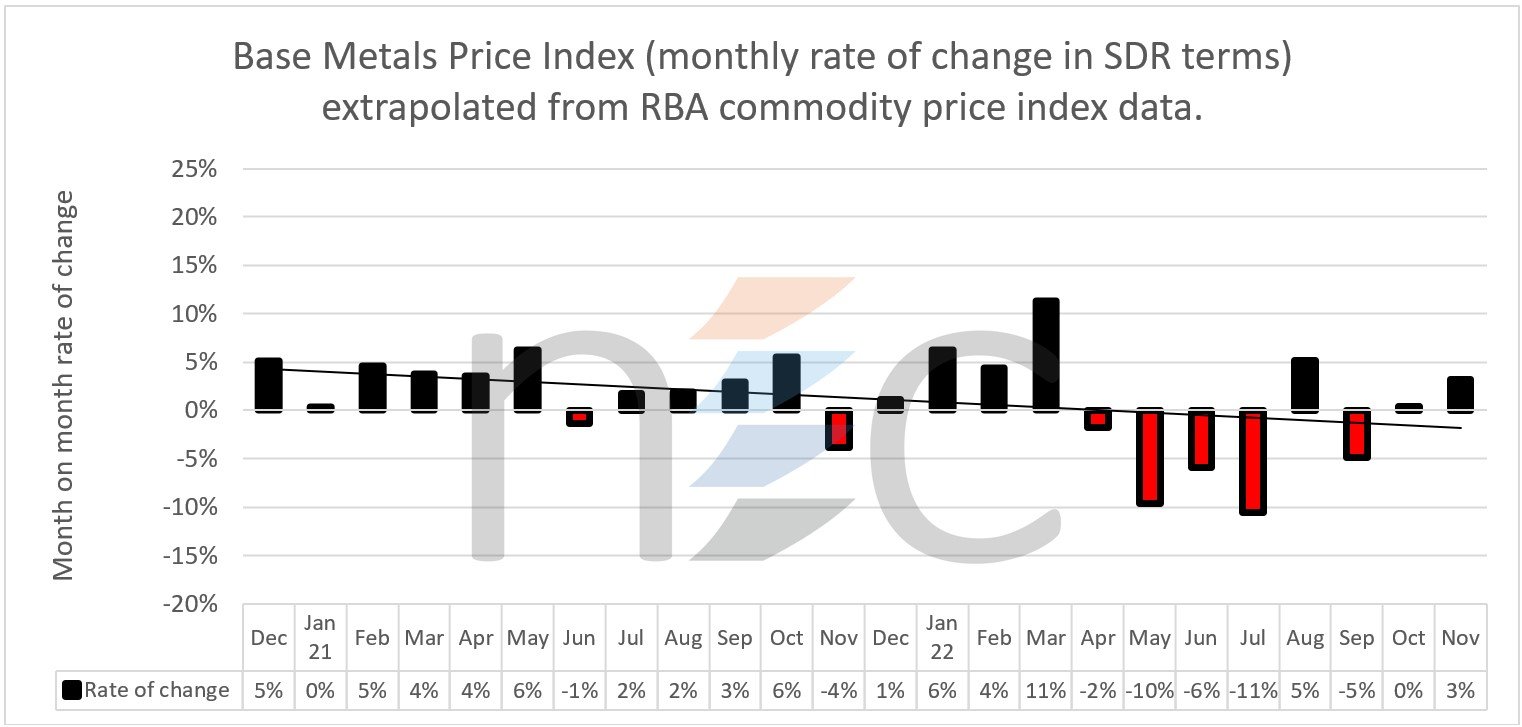

Base Metals

On the other hand, base metals were up with the index increasing by 3% in November compared to a zero change in October. Copper, nickel and other base metals have been in the press of late.

Still, these metals have nowhere near recovered from the punishment they took over the 4 months of April to July, post-Putin.

There is still a lot of ground to cover to get back to their once lofty heights.

Copyright NextLevelCorporate.

A relaxation of zero-COVID may be a game changer, but whether it’s a positive or negative change remains to be seen

If there is real relaxation of zero-COVID to appease the people, it may or may not change things for the better, and there is more than a passing probability that things could get worse depending on the impact and course of the virus.

First, there’s no evidence Xi will retire zero-COVID.

Second, even if there was to be a material roll back and relaxation there will be some pretty big hurdles to overcome.

Ineffective vaccines and zero-resilience due to lockdowns are the biggest ones.

Under a people’s revolution relaxation/full let-it-rip reopening scenario, there would be more people mingling and potentially catching new strains of COVID, potentially leading to lockdowns2.0.

Under that scenario, internal demand (now the largest component of China GDP) would fall, both in terms of consumption and its comatose property market (which may turn on the CEWC outcome on Thursday).

China’s not looking too good right at the minute.

RBA Chart Pack, 7/12/2022

Plus, from an Australian export perspective, we can observe a steady downtrend in exports to China (note the chart is lagged).

In place, we can see higher exports to Japan, South Korea and India, with total export volumes declining.

RBA Chart Pack, 7/12/2022

Be careful what you wish for and make sure you understand the second and third derivatives from an open China

Some scenarios:

Stay locked down = demand destruction.

Open up at the behest of the ‘people’, and COVID rips = higher iron ore and copper prices for a bit until demand destruction returns due to policy response.

Open up and COVID doesn’t rip = demand creation, assuming Xi happy to pay for energy/commodities and go through another bout of inflation.

Even under scenario 3, demand increases, more energy is required, and commodity prices are again bid up to levels that Xi will not be happy to pay and that will need a release valve. And with Russia still offside with NATO, there’s still no reliable incremental supply of cheap energy anywhere.

We need to assess the probability of each of the above scenarios.

Still, given COVID will not be at zero no matter what he does, Xi could at the opportune future moment reinstitute lockdowns with an “I told you so”. That probability is hard to assess.

Let’s see how this plays out.

In the short term we may see some higher pricing in iron ore and copper as the zero-COVID relaxation sentiment causes more bullish behaviour and support levels, but further out than that is just a guess.

For the moment, it might be a case of be careful what you wish for.

Mike

Next Level Corporate Advisory is a leading M&A and capital markets advisor with a 21-year track record of delivering the highest quality of independent financial advice as well as strategic transactions to help companies of all sizes level-up, in and out of Australia.

All text (other than for quotes and data sourced and attributed) in this article is copyright NextLevelCorporate.