The nuts and bolts of the 2022 tightening

Image: Erik Mclean

We are only at the beginning of official tightening programs from most key central banks, other than for China and Japan which are easing/stimulating.

And markets are acting as if the tightening has already occurred.

That’s because a lot of it has.

Check out the U.S. 10 year bond yield. It’s nearly doubled since just before Russia invaded Ukraine.

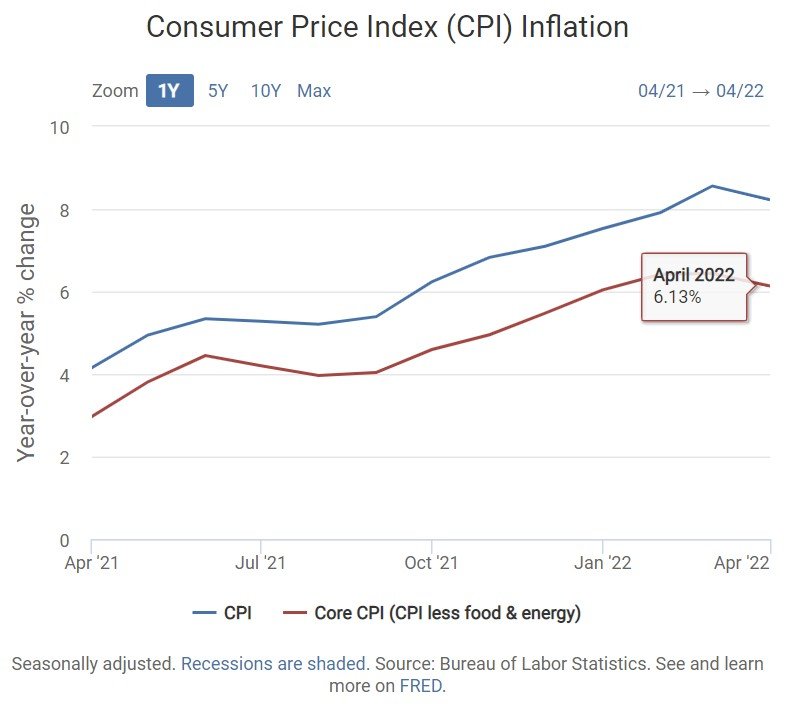

……..and look at CPI and core CPI, which have both started to roll over indicating an element of demand destruction. We may have seen peak inflation.

Source: FRED

Really? How?

Effectively, the nuts of the real economy have been tightened by an extensive tray of unofficial spanners. Here they are:

war in Europe causing withdrawal of Russian energy from the global seaborne trade and tightening supply and then pushing up oil and gas prices for firms and households

high LNG prices (up 14x in a year) causing high fertiliser and food prices

high commodity prices causing higher material input costs for infrastructure and finished goods and limiting the ROI and supply of renewable projects, and in turn increasing the demand for and price of fossil fuels amidst tightening supply

export bans of Indian grain and other commodities in other countries removing additional supply and tightening conditions

losses in the equities and bond markets and higher mortgage rates with U.S. 10 year bonds already trading on a yield of just under 3% and all together tightening discretionary spending budgets

economic contraction in China (not necessarily fully correlated to COVID) seen in tanking industrial production and retail sales from a country that consumes between 40% to 50% of the world’s natural resources, potentially in an attempt to curtail prices (nothing like strategic lockdowns and indefinite COVID-zero to destroy demand!)

for countries outside the U.S., an increasing USD (wrecking ball) where those countries require more expensive USDs to pay for their imports, swap into higher interest rate investments in the U.S. to earn yield, and repay/refinance USD debt that’s maturing

The Fed’s spanner might be holding the bolt, but it’s those real geo-eco-political spanners that have been twisting the nuts of the real economy.

They’ve been stripping away liquidity from firms and households faster than actual open market operations of central banks.

But that doesn’t mean the inflationary impetus won’t come back if the U.S. Fed’s tightening is stopped prematurely.

And for the moment that means the Fed won’t take it’s hand off its spanner.

Most likely, the Fed will continue to twist its liquidity removal bolt one or two more turns before pausing, perhaps towards the end of this year.

But just as two spanners do a better job than one, you don’t want to tighten too quickly, otherwise you risk stripping your bolt such that your nuts fall off.

Still, and even though there’s been an inflation spike in Europe (predominantly due to energy and food shortages) there’s growing freight behind a pause in the U.S., from Atlanta Fed Chair Bostic.

Last week, Bostic stated that his baseline is that a pause in interest rate hikes in September might make sense depending on the on-the-ground dynamics that the Fed starts to see at that time.

So, it might be two more turns (or one, if we have a sharp contraction in demand) over the northern summer.

If that’s enough by that stage, we might then get the Bostic pause while the unofficial spanners keep just enough pressure on the economic nuts.

If that thesis is correct, are your financing and investment strategies positioned to take advantage of the above - or do you think inflation and high rates will be firmly anchored for years?

Mike

Next Level Corporate Advisory is a leading M&A and capital markets advisor with a 20 year track record of delivering the highest quality of independent financial advice as well as strategic transactions to help companies of all sizes level-up, in and out of Australia.

All written content in this article is copyright NextLevelCorporate.