Some Aussie charts to make you go Hmmmm...

There is a time for everything. A time to sell, a time to buy, and a time to cry.

Hopefully we won’t be doing too much of the latter, but understanding the macro backdrop and taking its pulse to see how alive or dead it is, is a great place to start when you’re plotting out your corporate (or investment portfolio) strategy for a new year.

So, here’s a bit of pulse taking of the domestic macro backdrop as we start 2023 with the help of a few charts from the RBA chart pack (noting that RBA data can be a quarter old).

Charts that make you go, hmmmm

Business investment is the lowest it’s been since 1992.

Private non-financial company profits as a % of GDP (other than for mining which has mooned) has collapsed. Mining is carrying National corporate earnings.

Australia’s central banker lost $57 billion from bond purchases and after gains in other areas, still disclosed a $37 billion loss. The RBA won’t be declaring a dividend to Government until this hole is plugged. An independent panel has been assembled to review the RBA’s decision making.

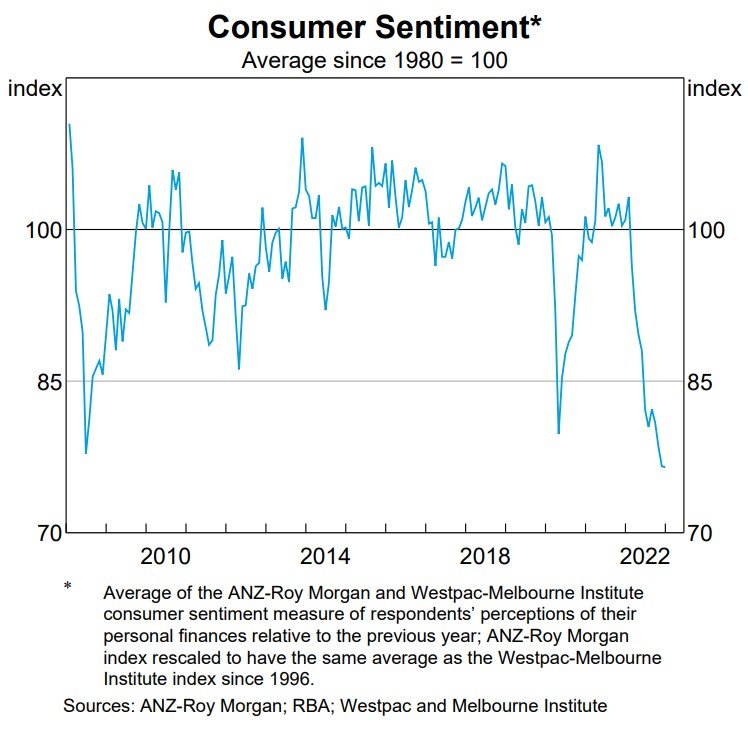

Interest rates have been raised by the RBA at the fastest rate ever seen in Australia and as with all things, it’s the rate of change that mostly influences behaviour. This is premeditated and helps to explain the wildly negative consumer sentiment.

Consumer sentiment has made a new 14 year low, i.e., below that of the GFC.

Bond yields have mooned, and prices have cratered and Australian investors with a 60/40 portfolio did not receive an effective hedge from this strategy, this time around. Lower returns have dragged down the ability for households to spend.

Equities went sideways and with bond prices also down, wealth accumulation via growth has not been easy even for those Australian investors that are able to access those asset classes.

Mortgage rates have tripled in a very short time period creating a rather disturbing rate of change and one of the fastest rates of change ever, even though the actual level remains well below the 17.5% in the first month of 1990.

It’s reminiscent of 1993 to 1994 and the ability of over-extended home buyers to rapidly calibrate to higher interest rates is profoundly weak.

Businesses have also been subject to a rapid increase in the cost of debt capital within a very short period of time. Zombies beware. Expect insolvencies.

Even bank net interest margins have been in long term decline.

So too has the Australian dollar against the USD even though it has perked up of late.

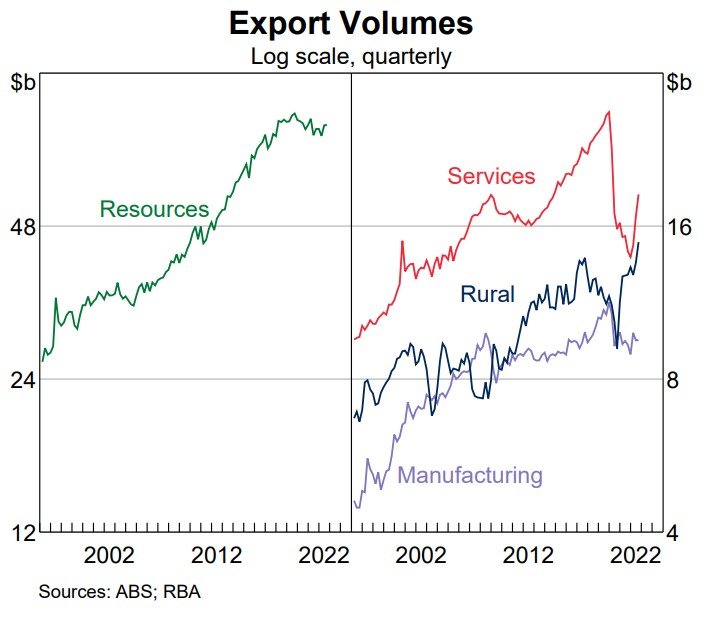

But as I have often written, that can be a good thing for USD denominated exporters but not so good for importers during times of inflation.

And while they have gone sideways a little due to China’s lockdown, there is still strength in the bigger category (resources) and that remains Australia’s silver lining. That plus rising rural exports, albeit declining prices in some categories. But these positives do not benefit all Australians equally.

While Australia’s natural resources endowment/export trade is immense and fills Government royalty coffers, Australian households on average are not as robust and that is where Australia’s key economic risk lies compared to say the U.S.

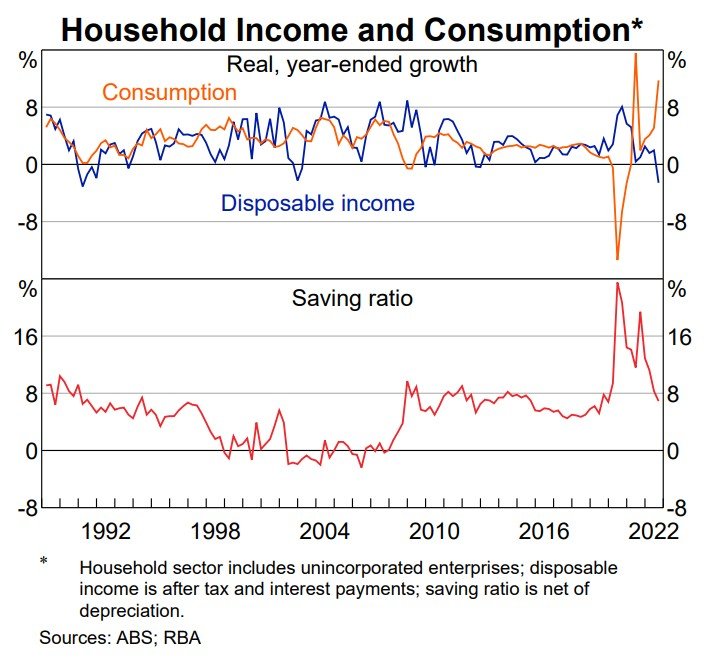

Top of chart below: After-tax disposable income of households is declining at the fastest rate since around 2002/3 at the same time as consumption has been mooning from pent-up services demand as well as higher prices due to inflation.

Bottom of chart above: Savings rates have tanked since COVID welfare stopped (and inflation took hold). This is different to the U.S. experience where personal balance sheets are stronger due to the size of the COVID liquidity tsunami from the Fed and Treasury.

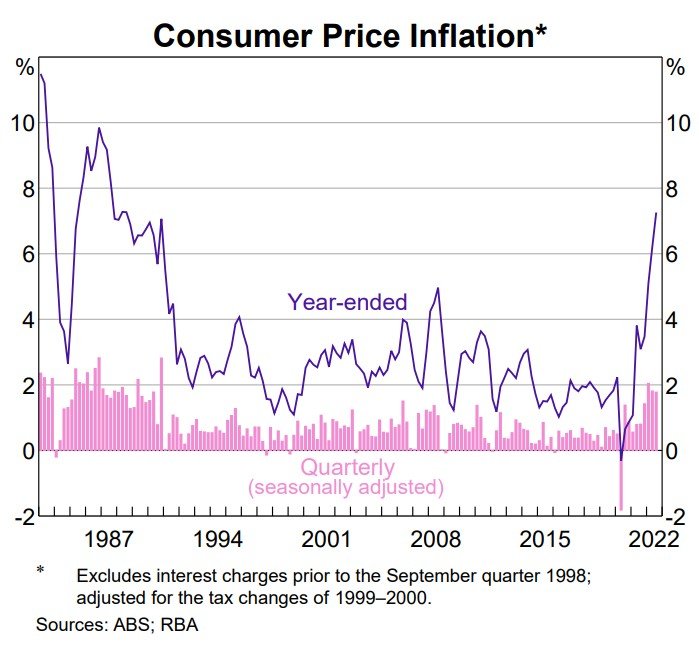

Inflation has emerged at levels not seen for decades and if you’re under 40 you’ve never experienced this.

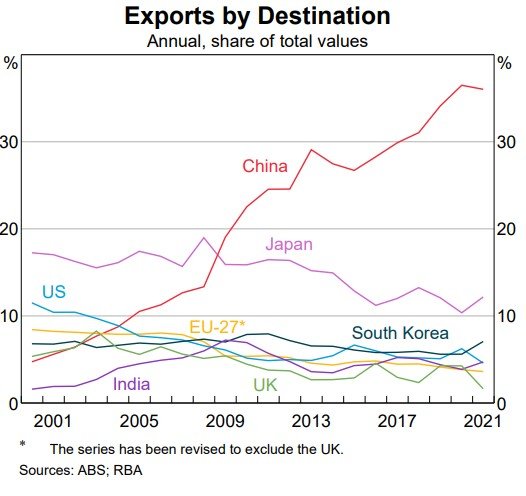

And while we are selling more to Japan once again, China is still our biggest export reliance as can be seen by sideways exports and high China reliance.

BUT, not unlike the U.S. and some other countries, so far unemployment is still low and appears to be the last act on the play before the RBA might be forced to capitulate (same scenario as in the U.S.).

Core inflation and unemployment rates are now the two most important leading indicators being used to predict the timing of potential changes in monetary policy regimes, right around the world.

Drawing it together

So, here’s the backdrop I think we are looking at:

Multi-decade low business investment as a share of GDP.

Non-financial private corporation profit as a % of GDP has collapsed other than for mining which is carrying domestic corporate earnings growth thus far.

Weak households from rapidly deteriorating disposable household income and savings due to inflation and interest rate-led demand destruction.

Ongoing high consumer price inflation that’s not yet back in the bottle.

Strong impetus to raise/keep interest rates higher for longer to tame inflation, but not too high to barbeque households, and still no recession factored into secondary investment markets.

Multi-decade low consumer confidence.

Loss of RBA credibility, bringing into question whether the Government will need to rethink/revitalise Fiscal policy because the RBA is possibly incapable of heavy lifting and has already broken the market with a failed yield curve control experiment last year.

Japan exports arcing up, but Australia still inextricably tied to China’s hip and now facing CMRG pressure to provide China with more pricing power in the iron ore trade.

Higher rates for longer in the U.S., and Europe with bond market vigilantes calling BS on central bankers’ ability to keep going - but as bonds/equities rally, the Fed needs to keep some pressure on or risk a head fake and fall back into higher inflation. And there’s still nothing to suggest Powell has changed his mind on reaching a FFR of somewhere above 5%.

But so far, unemployment in Australia is still surprisingly low and that will feed into the RBA’s view on its policy response and probably pushes a capitulation in policy, further out. Maybe some more 25 basis points step ups but keep an eye on core inflation and unemployment as it could spoil the RBA’s normalisation attempts.

For me, the above confirms we are still in a contractionary phase of the business cycle here in Australia, exacerbated by some liquidity withdrawal and interest rates that are high (but not high enough/quick enough to stamp out inflation) and weaker household disposable incomes as a result.

In saying that, a recession does not appear to be factored into Aussie investment markets. A recession does not appear to be factored into U.S. markets either. Corporate earnings are down but nothing wholesale just yet, although they are expected to weaken.

Our dollar’s relative strength to the world reserve currency will remain subject to the machinations of the Fed’s stance on monetary policy and liquidity withdrawal (for the moment) and the ripple effect on the USD, but it will also be guided by the China experience as mentioned above.

On the other hand, the effect of the Bank of Japan’s widening yield curve control target might be to keep more money onshore in Japan, propping up the Yen instead of the USD as the treasuries yield curve backs off a little. This in turn might make much needed Australian exports way more affordable in Japan.

We might also see some fighting between Japan and China when it comes to coal, given China’s recent relaxation on Aussie coal import bans. But unlike iron ore, we don’t have a 70% dominance in the seaborne coal trade despite our proximity to China.

Maybe RBA rate hikes go small or slow or there is a plateau/pause, but a capitulation or pivot (i.e., rate cutting) before rising unemployment (and before the Fed softens) does not appear likely.

I see Australia’s fortunes for the next period being a function of whether China can grow or not and provide a growth impetus to turn the cycle here, and/or whether the Albanese Government can repair the China relationship, our Fiscal platform, and keep unemployment low in the face of the headwinds discussed above.

And with weakening household balance sheets and P&Ls the RBA appears to be in a predicament.

For me, it feels like the macro in Australia will grind away in a long and drawn-out channel to the right, with a return to stimulus still some way off, despite investors front-running assets that do well in high liquidity/low growth environments.

We need to watch corporate profits and unemployment as leading indicators for what is to come from Government and the RBA in light of still high inflation, weakening household savings, shrinking disposable income and demographics. But we are not a debt laden country, and our resources are likely to remain in high demand.

Other countries will be watching the Australian and NZ household sectors for signs of instability due to our heavy reliance on China. In other words, we become leading indicators for other developed markets in a near ‘post-COVID’ geo-politically splintered world where there are many questions over China’s growth trajectory.

Agile Cherry picking of sectors and pockets of growth in high demand areas will be key in 2023 and I expect to see many companies pivoting, diversifying and/or consolidating to catch tailwinds and dilute out the headwinds. And there’s trillions of private equity waiting to help.

As usual, I might be very wrong, plus regimes can change quickly, but I hope the above provides you with an alternative perspective on the Australian macro backdrop as you consider your strategies for 2023.

See you in the market.

Mike

Image: Mike Van Schoonderwalt

Next Level Corporate Advisory is a leading M&A, capital and corporate development advisor with a multi-decade track record in transforming businesses and helping owners with customised financings, mergers, acquisitions and divestments, in and out of Australia.

All text (other than for quotes and image text) is copyright NextLevelCorporate.