RBA in a fog, but mind the 165bp spread with the Fed

Image: Matt Hardy

TL;DR

Unless U.S. inflation seriously surprises on the downside, rates are going up again in May.

Meanwhile, the RBA hit the interest rate hike pause button.

Spreads are now widening between U.S. and Aussie interest rates (145 basis points higher in the U.S.) and if the RBA does not raise rates next month, the spread will be around 165 basis points, the largest it’s been in decades.

And even that camouflages an even worse situation because in real terms (after adjusting for inflation) the spread is 330 to 355 basis points in favour of the higher real yielding USD!

This is not a good strategy by the Reserve Bank of Australia (RBA).

I say this because most international trade (in and out of Australia) is denominated in USD and a widening spread leads to more expensive imports, sticky inflationary forces, lower corporate margins/earnings, and extended pain for Aussie households which are weaker than their U.S. counterparts.

Ugly indeed.

And despite the differences across countries and the lack of a Fed interest rate announcement until May 3rd, Governor Lowe needs to mind the spread, despite the April fog.

April fog

We are currently in a monetary policy fog until 3rd of May.

At that time, the U.S. Federal Reserve’s open market committee (FOMC) will meet and decide on the next interest rate move for the world’s reserve currency.

Not convinced about the Fed’s higher for longer call in March, RBA Governor Lowe paused rates last week and he might now be waiting to see which way the Fed will lean before he makes his next call.

He won’t know for sure, because the Fed won’t announce until a day and a half after the RBA, but we kind of know already.

Despite last week’s lower than anticipated U.S. jobs for March (236,000), U.S. unemployment actually dropped back to 3.5% (from 3.6%). And unless U.S. inflation comes in surprisingly cold (low) or a few big banks blow up, the Fed is likely to hike interest rates again in May, according to plan (and the dot plot you’ll find in the next section).

That would take the Federal Funds Rate (FFR) from a range of 4.75% to 5% (current daily rate is 4.83%) to a range of 5% to 5.25% based on a 25-basis point hike. Comparatively speaking we are at 3.6% here in Oz.

Powell’s seeming lack of love in raising rates isn’t emotional. Nope, it’s clinical and comes from what he sees as supportive conditions for further tightening so he can get rid of the inflationary scourge that President Biden wants gone, yesterday.

A ‘so far so good with strong U.S. households’ underpins Powell’s confidence

Chair Powell’s seemingly cavalier rate hike penchant comes from confidence in U.S. household balance sheets.

He should know, he and Treasurer Yellen created that strength through ample monetary and fiscal response during COVID - 4 trillion of it and counting.

U.S household debt serviceability is high and predictable, there is still historically low unemployment, strong consumption, a lack of broad-ranging price disinflation, and a liquidity backstop the U.S. treasury has in place for banks in the event another one or two regionals get the wobbles. Specifically:

Well above goldilocks rate of job adds - approximately 100,000 monthly job starts is what Chair Powell believes is needed to keep up with population growth. The 236,000 job print in March is still more than twice this level.

Historically low unemployment - unemployment reduced from 3.6% in February to 3.5%, the same as it was before COVID hit in January 2020. Some clouds are beginning to appear with tech company layoffs, but the overall unemployment rate is still extremely low.

Banking sector duration squeeze liquidity backstops - the combined force of the Treasury and Fed delivered a ‘nothing to see here’ outcome for banking instability (through the BTFP as I wrote about recently), and Credit Suisse was sold to UBS. While this probably means UBS will become the bellwether ‘cot case’ for European banking, it also means Powell has been left to do his job. Also, the discount window (lending direct from Fed to banks at an interest rate) is further support.

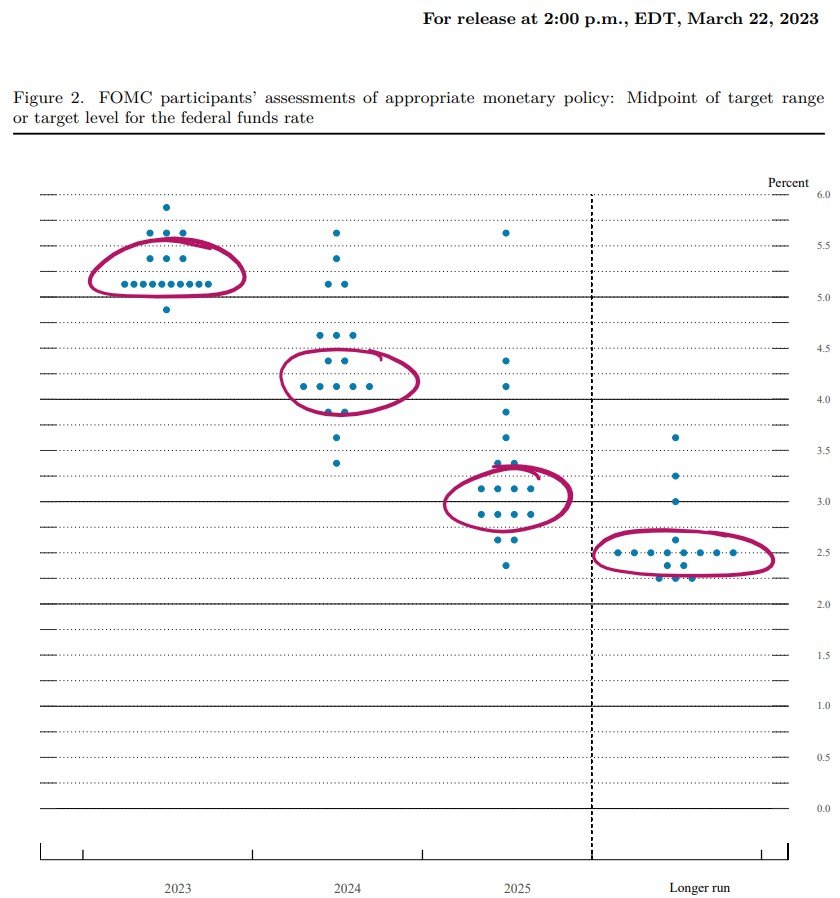

FFR dot plot guidance was emphatically >5% – a very recent survey of Fed system governors indicates that 18 governors are still expecting a FFR range of between 5.25% and 5.75%, this year.

Strong households – this is not at all well understood by Australian markets when contrasting the two countries. Americans are more able to recalibrate their household budgets than Australians due to the over ample COVID response stimulus received in the U.S. and the way housing finance operates between the countries. In the U.S., around 71% of household debt is made up of mortgage finance (a US$12 trillion market) and of that, around 70% of mortgages are 30 year fixed, 10% are 15 year fixed and the rest are 5 and 7 year adjustable rate mortgages (ARMs). The 30 year fell to a low of 2.76% at the end of 2020 and the 15 year fixed rate fell to 2.17% by the end of 2021. Imagine fixing in for 15 years at 2.17% in Australia - you can’t! Even the year ARM hit a low of 2.47% and is now at 4.51%. So, only around 3% of U.S. mortgages are ARMs and the balance of households have long term low fixed rate certainty and predictable serviceability. Also, mortgages in the US are tax deductible. So, as long as the Fed thinks/guides that there will not be continuing mass layoffs, this structural household debt contrast between the U.S and Australia bodes well for a Fed Chair that wants to tighten interest rates.

There is still no empirical evidence to justify standing still on rates.

Maybe that will happen this year, but we’re not there yet.

Lowe’s confidence is low, so he paused

This is very different to what RBA Governor Lowe has been facing in Australia.

The RBA needs to cater for a relatively weaker household sector, impending mortgage pain, cratering household savings and still very high inflation (monthly inflation indicator for February 2023 was 6.8%).

But there will be currency issues and inflationary pressure if the AUD and USD spread gets too wide.

That is to say that if the Fed moves to a range of 5% to 5.25% (if not higher) on May 3rd and the RBA stays on pause, we will see a 165 basis point spread between the FFR and Australian official interest rates which are paused at 3.6%.

That size of spread rarely happens as per the circled periods in the chart below.

This time, it would represent one of the largest, if not the largest spreads in decades. A seriously reverse carry trade, sucking money into a higher yielding USD, not Australia.

But it’s even worse than that because real rates (nominal rates less inflation) in Australia are negative 3.8% and, in the U.S., real rates are negative 0.5% to negative 0.25%.

That’s a 330 to 355 basis point real spread!

Such a large spread would further weaken the Aussie dollar against the greenback unless China commodity volume/price growth were to surprise on the upside, and/or if Governor Lowe were to defend the currency by direct purchases of AUD.

Further AUD weakening in a high inflation environment is not a desirable outcome.

Why? Imported inflation from a strong USD would hurt all Australian households and businesses that pay for liquid fuels, cars, intermediate/finished goods and services.

If that’s how it plays out, inflation would likely reoffend, and corporate earnings would come under more pressure at the margin level.

And under a labour government there would be more pressure for wage rises to chase price rises, risking an inflationary spiral.

Solution for businesses? Lay off people. Outcome? Major struggle street for weaker Australian household vis-a-vis U.S. households.

And that is unpalatable to a Labour government, so we would be better off importing as little inflation as possible particularly if the USD also gets stronger.

Time to get the spread back in range

There are good reasons to argue that the RBA’s recent pause is not good monetary policy.

In many ways, the RBA has stalled the inevitable antidote (quick and decisive interest rate increases) and weakened the efficacy of that antidote with every passing month that inflation is left to run in a non-transitory direction!

Raising rates and taking more hits to the RBA’s bond portfolio (and some household budgets) might be the price it has to pay to stamp on inflation’s throat.

And given Treasurer Chalmers has agreed to not ask for an RBA dividend until the $37 billion hole from bond losses has been plugged, go for it!

While all central banks waited way too long to take away the punchbowl of free and easy money, Lowe still has a window to ‘go harder’ and get tightening/demand destruction out of the way and close the spread between the two nations.

Alternatively, waiting for geopolitical repair and Aussie dollar strength from a reprisal in China demand (yawn) is going to feel like death by a thousand cuts.

Clear the fog, do something, one can always pause, cut and kick the monetary can down the road again, later…….

Mike

Next Level Corporate Advisory is a leading Australian M&A, capital and corporate development advisor with a dealmaking track record spanning three decades. We help family, private and publicly owned companies build and realise value in their businesses, assets and investments.