Supercharged or Super-taxed? Australia’s quarry to quantum choice

Wait, you weren’t expecting this?

Over the past decade, Australia has doubled down on what it knows best: digging, shipping, and selling.

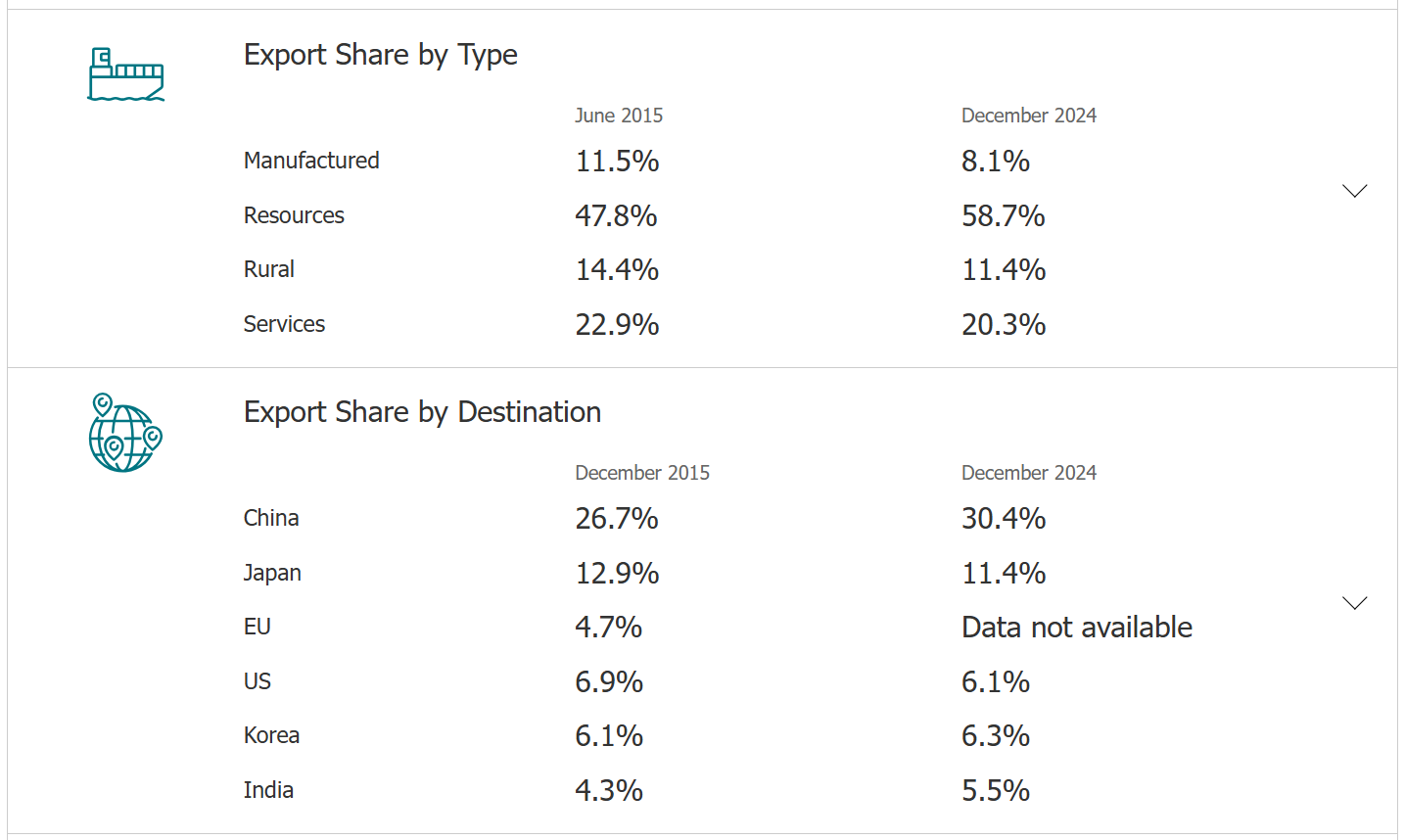

Resources now account for nearly 60% of our exports, up from 48% just ten years ago—mostly going to China and Japan.

At the same time, manufacturing has shrunk by a third, and our much-hyped service economy did take share for a few years but in total, its share of the pie shrunk.

You can check it out below in the RBA’s latest released metrics.

Reserve Bank of Australia, latest comps.

This is more than just a shift in trade composition—it’s a window into how Australia has allowed its economic complexity to regress, favouring short-term extract, crack and stack over long-term value creation.

It’s tempting to frame this as a debate about energy—about whether nuclear power, and small-scale modular reactors can anchor an industrial revival.

And yes, nuclear deserves a seat at the table. But the real conversation is bigger and more urgent where access to global GDP just got harder as we continue to splinter into regional near/friendshoring supply chains.

No, the debate isn’t about nuclear, it’s about innovation, sovereign capability, and capital allocation in a high-stakes global re-regionalisation game.

A capital-rich, strategy-poor Straya

But let’s refocus on a few facts.

First of all, Australia isn’t short of money.

Our superannuation system holds $3.7-3.9 trillion (depending on who you ask) which makes us one of the largest retirement savings pools in the world.

But the overwhelming majority of that capital is allocated to offshore equities, infrastructure, and property, while domestic innovation and industry-building are left starved of capital.

This misalignment has led to a paradox: we are rich in funds, yet poor in productive capacity.

Our innovators often have to look overseas for funding, and our institutions are rewarded more for buying toll roads in Spain or backing U.S. based crypto IPOs than for backing the next sovereign capability in quantum computing, advanced manufacturing, or a nuclear-powered space port.

At the same time, we watch as other nations—particularly the U.S., and EU—aggressively realign capital, regulation, policy and industrial strategy to back next-generation technologies.

These aren’t just moonshots, they’re job engines, export enablers, and economic moats.

But here in Straya? 🤷♂️

Crikey, we’re literally laser-focussed on redistributing wealth while we risk becoming a client state in the new industrial age—digging, lifting, shifting, shipping and reimporting what we should be able to produce.

And if we don’t get our geopolitical story on an even keel—we risk reimporting our iron ore back in the form of naval hulls and incendiaries.

If we’re simply not willing to do the hard yards to value-add what we grow and dig—we may as well light the blue touch paper ourselves.

Super-tax or Super-strategy?

That’s what makes the current conversation around taxing superannuation, particularly unrealised gains in larger balances, feel so frustratingly narrow.

It may make sense politically (maybe). But it misses the far more important question:

How do we mobilise super to take some concentrated, high-conviction, nation-building risks to help fund and secure Straya’s future?

If we are going to ask Aussies to forego tax benefits on their retirement savings, shouldn’t we at least be making that capital work harder at home?

Imagine if even 2% of the super system was allocated—under prudent, risk-structured models—into national innovation, advanced energy, and sovereign capability.

That’s $75 billion of rolling-patient capital that could rebuild manufacturing, commercialise breakthrough science, and scale energy technologies, like nuclear-powered robots.

Not as handouts—but as structured, disciplined investments, with governance that reflects both national interest and fiduciary responsibility. And there will be more GDP to tax, right?

From quarry to quantum, the great divide

Australia's core challenge is not just that we export rocks. Rocks are a cracker of an industry and should not be vilified.

No, it’s not that, it’s that we haven’t built the systems to turn ideas into businesses, or savings into innovation capital.

We’ve relied too heavily on the comparative advantage of others, and in doing so, allowed our manufacturing skills and post-war labour advantage to erode.

This is not an argument against resources. It’s a call to complement them with industrial depth, tech capability, and a strategic use of our own land, labour, capital and smarts.

It’s a call to use our $3.7 trillion war chest—not to fund someone else’s future, but to help build our own, while fully leveraging the power of exponential technologies in quantum computing, robotics, automation, artificial intelligence and zero emissions energy to power it all.

You can get a refresher on what I wrote about nuclear robots back in March 2024, here. Back then, I posed that nuclear powered robots have the capacity to eat away our non-tradeable inflation. And with the RBA leaving interest rates on hold as a result of still sticky inflation (good call by Governor Bullock, by the way) that’s mainly non-tradeable, perhaps the Government should be listening.

Straya has all the ingredients—we simply need to remeasure them and bake them properly to get more quantum in the quarry—and FFS, can we please fix the golden goose instead of fighting over who should get the golden eggs?!

See you in the market.

Mike

With decades of success across six continents, NextLevelCorporate expertly navigates the intersection of M&A, financial advisory, and business strategy—delivering macro aligned corporate development strategies and the financial transactions that bring them to life.

All content is copyright NextLevelCorporate. NextLevelCorporate and logo are registered trademarks. All rights reserved.