Metals Roundup Aug'25: Tariff the bulls, get a truck load of bears

Copyright, nextlevelcorporate, 2025.

TLDR: August 2025 Metals Roundup

In the past 9 months, there’s only been one acceleration in Bulk prices. That occurred in July 2025.

But last month, Australia’s bulk commodities index (mainly iron ore and coal) increased at 2%, half the pace of July’s acceleration. The cautious bulk bulls of July were overly cautious and turned into bears in August—no longer defying the backdrop of trade tensions, soft China data, and cautious sentiment.

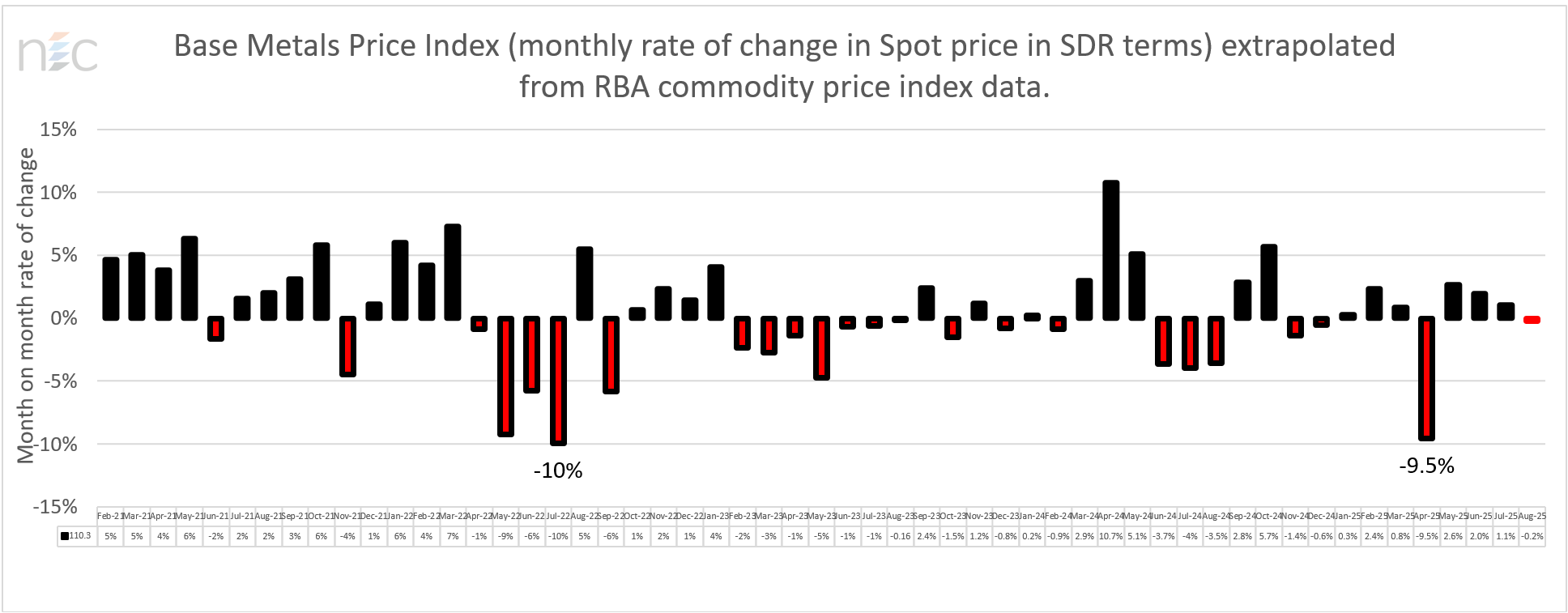

And base metals? Well, negative price growth returned after three months of cautious growth. We’re still in a secular downtrend

So, what’s been going on?

Trump’s tariff blitz missed raw commodities, and instead hit finished metals (steel, aluminium, copper semis) and as I noted last month, spared raw materials like iron ore and coal. However, what’s more pronounced this month is more cautious global trade and a still strong USD which are both dampening aggregate demand.

China restocking signals stirred markets in July but petered out in August. Yes, it was short-lived.

The copper rally continued to ease off. The front-loading effect of U.S. tariffs continued to fade. If we enter a genuine rate cutting cycle in October and of the USD weakens (still a question) copper may strengthen in a few months.

Speculators took profits and funds began to trim commodity longs after a strong run earlier in 2025. As price moves turned more technical than fundamental, metals cooled—except where supply discipline and trade policy provided a firm floor. Frankly, many will be rotating into gold now that it’s broken out to the upside.

For now, real strength still hinges on China’s next steps, the strength of the USD and the favourable way Australia is being treated by the White House in terms of the 10% tariff reset.

The future is starting to look brighter for our industrial commodities, but the real bulls are still hiding in the mist. Uranium is already part of the conversation, and 81% cratered lithium is trying to join in. Trying, but so far failing.

Finally, anti-debasement gold finally broke through the $3,500 level after testing that level six times since April. Next stop? Up.

Overall head and shoulders still in play

The overall commodities price index (includes hard and soft commodities) is still caught in a bearish head and shoulders pattern. It feels like there’s still more weakness to come before we can confirm a new cycle, and it remains my belief that it will only come from a combination of direct China stimulus and a weaker USD.

Your Charts for August 2025

🔗🏮🔌 Base Metals

The tariff front-loading trade is exhausted.

The next leg of copper price strength will require a stronger demand impulse from Beijing—not Washington, and a weaker USD.

Copyright, NextLevelCorporate Advisory

🧱👷♀️🌉 Bulk minerals

The bears are back on the dying embers of price deceleration.

Thus, the bulls are bears until further notice.

Copyright, NextLevelCorporate Advisory

⚗🧲☢ Energy minerals (ex-coal and oil)

The July 6, 2023, price high for LME Lithium Hydroxide CIF was US$46,046.

On the last day of July, it had continued its collapse, this time to US$8,520/t up 5% month on month yet more than 81% down from its July 2023 peak. This is despite everyone still in the game talking it up.

Spodumene prices increased by 40% at the beginning of August and then proceeded to lose most of the gains, crashing to a level representing a 13% increase, not 40%. Short-lived? Hmmm.

Uranium is firmly back in the narrative—with month end spot trading at US$76/lb—driven by data centres and increasing capex spends from Google, Microsoft, and Amazon. But LNG and coal are quicker, and more present sources of energy.

I continue to expect fossil fuels to make a structural comeback given global demand for energy driven by data centre formation. And what that means is that we will need every calorific unit available, which I’m sure will be repugnant to die hard green transitioners—but reality, nonetheless.

Summary implications from the July print

As I mentioned last month and in the months before, we’re still seeing cyclical dollar weakness within a secular or long-term dollar strength thesis. In the event Trump gets his way with interest rate cuts, the dollar should weaken, providing respite to sovereigns outside the U.S. That’s because a gentler dollar creates liquidity in those countries and creates abundance in the force, aka the Eurodollar market—and that fires up demand for nation building projects and fiscal largesse.

Implications for corporate development: If we do have a real interest rate cutting cycle in Australia this year, greenfield projects delivering into the drivers outlined above might start to emerge.

Implications for investment: Iron ore and coal prices may be on the comeback trail. We’re waiting for confirmation with much resting on U.S. trade policy and China demand/stimulus. Uranium looks strong. Coal and fossil fuels are still required and are not going away any time soon (or for many decades). Aussie copper has been spared U.S. tariffs, but it remains a USD story (despite supply shortfalls) due to “affordability”.

There is renewed upward pressure from a precious metal perspective as a result of interest rate cut signals from Jackson Hole and comments from Fed Chair Powell last week. And since GDP growth can’t keep up with debt growth, the secular uptrend in gold is still in place, despite extended profit taking—and that rising pennant is looking bullish, no? 😎

See you in this golden market.

M

With decades of success across six continents, NextLevelCorporate expertly navigates the intersection of M&A, financial advisory, and business strategy—delivering macroeconomically aligned corporate development strategies, with bespoke transactions that bring them to life.

All content is copyright NextLevelCorporate. NextLevelCorporate and logo are registered trademarks.