Sober October for industrial commodities

Image: Nohk

Global demand destruction from central bank interest rate hikes and hawkish guidance along with Xi’s zero-COVID policy has tamed industrial commodity prices. But for how long?

Energy commodities on the other hand, like lithium (~200% up on EV demand), thermal coal and oil (under-investment and Russia/Ukraine supply shocks) are increasing. Even no-brainer global baseload power candidate Uranium (sorry about the personal view there) is also having a renaissance of sorts.

In comparison, here are some quick charts illustrating the sober after-party trajectory for industrial base metal and steel making bulk prices, as measured by the incremental spot price using the RBA’s commodity price index.

The month-on-month rate of change to October in the base metals price index was a very sobering zero.

Source: NextLevelCorporate extrapolation from RBA Commodity Price Index,

Not so with bulks.

The month-on-month rate of change for steel making bulks and thermal coal resumed its deceleration with a 4% slowing in the index. This more than wiped out the growth over the previous two months.

Could have sworn iron ore purists were saying otherwise? Oh well, must have misheard. Maybe that was lithium…

Source: NextLevelCorporate extrapolation from RBA Commodity Price Index,

The black stacks of Rohypnol infused prices in both column charts above almost all occurred before interest rates were tightened in the U.S. and the USD went Darth Vader.

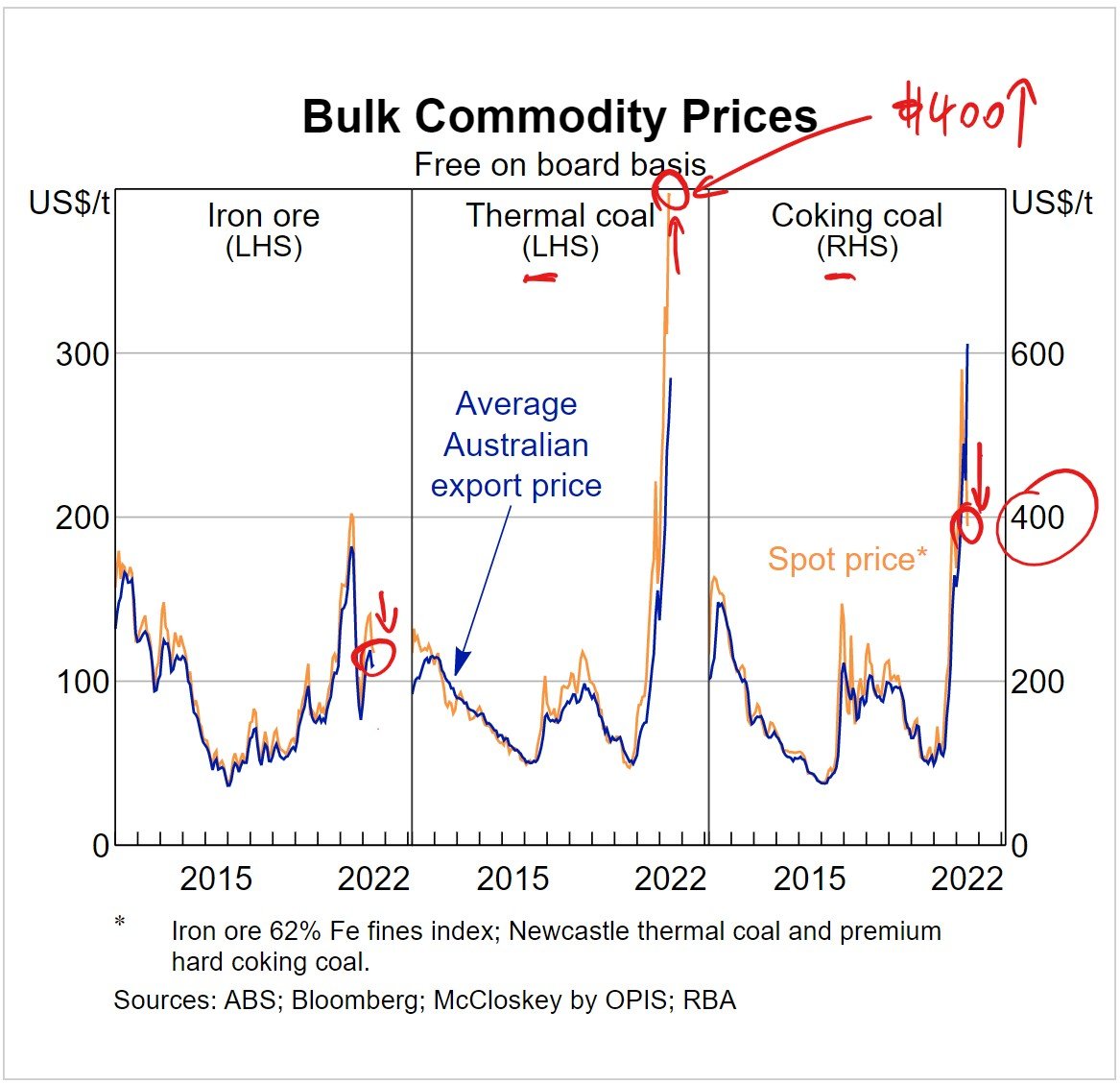

And the reason why spot bulk prices did not look worse is that at the same time as thermal coal prices were mooning to around US$400/t, steel making coking coal prices plummeted to US$400/t, and iron ore was belted.

Source: RBA Chart Pack, 2 November 2022.

The mooning of thermal coal prices due to underinvestment colliding with a slow green transition has camouflaged how fast iron ore and coking coal prices decelerated over the period.

FMG.ASX is down 31% since June and BHP.ASX is down 21%.

Meanwhile, thermal coal posterchild WHC.ASX is up more than 4x in the past year and diversified Fe, lithium and mining services champ, MIN.ASX is seriously up, and that’s down to its lithium exposure and forward roadmap.

And if the people pulling the strings there are really considering a shareholder sugar hit IPO of the lithium business, this jury hopes that MIN retains a massive chunk of it, plus a contractual interest for its mining services business. Give me a uniquely diversified Fe, lithium and mining services business any day of the week. Just saying.

And while not an industrial commodity, gold is a precious metal, a central bank reserve asset and when paired with Bitcoin has provided some dollar debasement shelter. However, as real yields continue to improve and the market wakes up to a pivot being further out, this makes non-yielding gold more expensive to hold, especially while currency debasement (QE Infinity on pause) has slowed for the time being.

That said, gold’s perkiness over the past few days has been a combination of Powell’s recent pirouette, i.e., smaller hikes but more of them - and this may have caused some premature forward look-through for precious metal traders.

Back to industrials - let’s see what happens to incremental (spot) prices for copper, nickel, zinc, iron ore and coking coal in November as markets start to fully factor in the Fed’s resolve to move to even further restrictive monetary policy (i.e., intentional demand destruction) with smaller but more hikes - or ‘Volcker by Stealth’.

It will also be interesting to see to what ridiculous levels lithium prices go, given we are already well extended beyond the moon.

Some final questions in closing: Will Dollar Vader continue to get stronger? Will we see a Volcker by Stealth in the U.S.? If we do, and if zero-COVID goes for longer in China (most likely) is there more weakness coming to commodity demand and prices? Will COP27 have any influence on fossil fuel policies and prices? And will lithium be the last price to fall, or will it continue to hurtle out of our solar system?

We shall see. Until then, see you in the market.

Mike

Image: Patrycga Grobelny

Next Level Corporate Advisory is a leading M&A and capital markets advisor with a 20 year track record of delivering the highest quality of independent financial advice as well as strategic transactions to help companies of all sizes level-up, in and out of Australia.

All text in this article is copyright NextLevelCorporate.