Aussie’s feeling bluest in decades

Image: Valeriia Miller

I thought it time to have a look at how we’re tracking here in Australia.

Downunder, GDP growth has rolled over.

So has global GDP growth.

And growth in China (the largest buyer of our commodities) has collapsed.

The Dragon’s sluggishness has been underpinned by a steady but sure decline in stimulus.

It’s all pretty much due to Xi’s geo-political recalibration as well as the energy and food ‘tax’ that would result from an unconstrained China.

Looking back to our shores, credit growth has also declined, with debt less affordable given interest rate hikes and tightening lending standards.

Credit has rolled over.

And that has a big impact on investment.

Since 2013, business investment as a share of GDP has been headed for and is now in the toilet - just like it was during the sticky recession period in the early 1990s.

Most of you won’t remember that. But it hurt.

Hmmm?

And in light of that grind lower and to the right, our saviour industry, mining, has become an even smaller share of total investment.

Wait what? Aren’t we meant to be delivering into a commodities supply shortfall?

Next, in trying to gauge the trickle down from declining growth and lack of investment, we look to wealth in the home.

It’s been tanking. Whereas liabilities have been increasing (read into that mortgages and credit cards and BNPL default rates that no one wanted to talk about) and you’re now only starting to hear banks talking about defaults, probably only in the last two weeks.

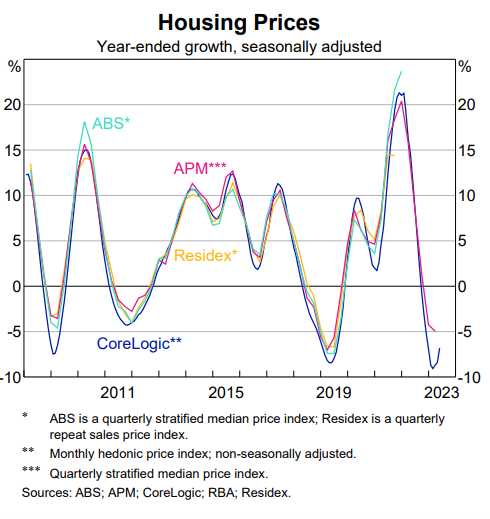

But worse still is that the collateral underpinning most mum and dad lending in Straya has been cratering for over a year (albeit Core Logic suggests that the rate of housing price decline has slowed).

Banks are worried. Yes, they are. Aggregate loan commitments have come down as interest rates have gone up and household savings have been barbequed while basting in inflationary oils - most of it imported oil resulting from a strong USD.

Now take a gander at the Ray Morgan Westpac “I’m feeling good/I’m feeling shitty” chart.

It’s lower than before COVID.

It’s lower than the trough of despair following the GFC.

It’s Lowe.

The depth of that survey tells me that households are the unhappiest they’ve been about their finances for decades. That’s probably deflationary.

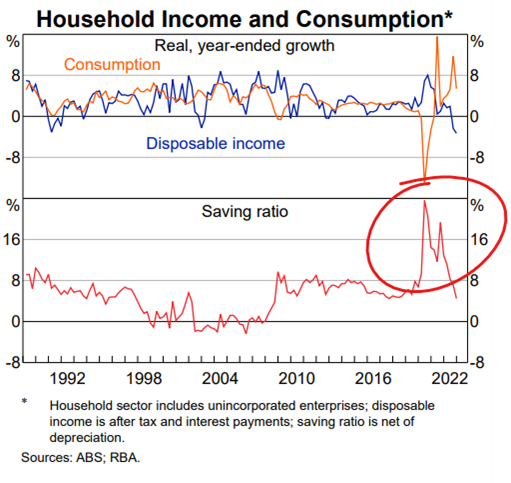

And now for the chart of truth.

The fake savings signal at the peak of the red line was caused by COVID largesse and handouts - but now that welfare has run out and we are on the other side of it, never have we seen a faster rate of decline in savings.

Hello?

The household buffer has vapourised. And the high savings and consumptions rates which made it look like we were in a growth leg of the business cycle, now prove that we were not in a real business cycle, at all.

Instead, non-productive fiscal welfare, due to lockdowns.

So where are we?

Well, we might have full employment, but we also have sticky inflation at 7% (April 6.8%) and a real interest rate of negative 2.9%. And if the RBA does what it should (that is to say, the RBA should continue to raise interest rates to strangle the inflationary impulse) there will be defaults and layoffs, and things will get worse before they get better.

Given the shape, angle and direction of all of the above economic indicators, it will be crucial for the RBA, banks and policymakers to stay that course, and at the same time work together to mitigate the impact of potential defaults and layoffs without creating a worse cure than the underlying illness.

See you in the market.

Mike

Next Level Corporate Advisory is a leading Australian M&A, capital and corporate development advisor with a dealmaking track record spanning three decades. We help family, private and publicly owned companies build and realise value in their businesses, assets and investments.

All text is copyright NextLevelCorporate.