Did we pull up to a stop, or a give way sign?

Image: Joe Pee

TL;DR - what the Federal Reserve signalled last week

At last week’s FOMC (Federal Open Market Committee) meeting, the Fed tapped on the brakes and gently glided up to a sign to wait for more traffic to pass.

But what was that sign? The market thinks it was a stop sign, again, but was it?

Well, the Fed confirmed the level of interest rates is still too low, because 4.5% core PCE is still too high - and there is no credible evidence that inflation is topping out or decreasing.

Explaining that rates need to be hiked further, the Fed decided to ‘somewhat moderate’ the speed at which it will happen by maintaining rates at 5% to 5.25%. And since the Fed thinks that it’s close to the desired destination (50 basis points away), it made sense to proceed with caution.

Hence, we’ve come to a give way sign with more rate hikes to come before the end of the year, which should take the federal funds rate (FFR) to a range of 5.5% to 5.75%.

Meanwhile, quantitative tightening (running down the balance sheet - mopping up liquidity) continues.

But as usual, the market has faded the hawk (ignored the Fed) and assumed that it was a stop sign, and that we’re already on the other side.

Journey’s end?

No.

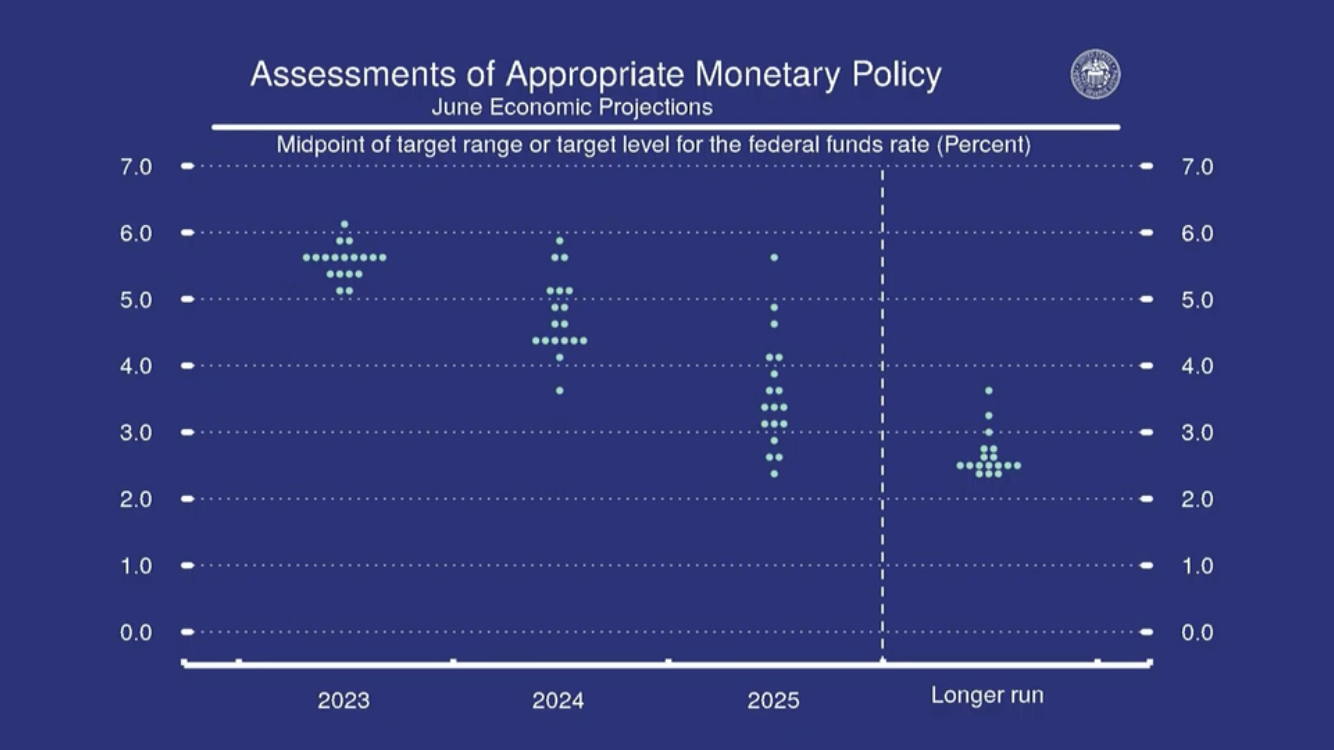

The dot plot below shows the Fed’s updated (and increased) view on where it thinks rates need to be to get inflation back to 2%, over time.

I’ll save you the time by filling in the blanks and saying that there’s been a major increase in interest rate expectations amongst all 16 committee members, and that the dot plot ‘curve’ has shifted up a full 500 basis points 👇👇👇

You should also note that there are three members that feel rates should be significantly higher, in all time periods. They are in the camp that believes that inflation is not just supply side related, but demand/wages related and way sticker than the other 15 members think.

So what?

According to the modal dots in each period, the committee currently feels that the appropriate level for the FFR will be:

5.6% by the end of 2023,

4.6% by the end of 2024, and

3.4% by the end of 2025.

And as highlighted above, a full 1/3rd of FOMC members feel rates should remain above 5% until the end of 2024. That’s 18 months from now. And, more than half indicated rates should remain above 4.5%, with 15% of the gaggle feeling that rates should remain above 4.5% by the end of 2025.

That is super hawkish. On the other hand, price action in equities suggests that the financial markets (don’t believe the Fed) can take it and can probably take more.

Not where, but when with interest rates

Level is clear (higher). Speed is unclear. But there’s certainly no red stop sign in sight, today.

Clearly, the Fed’s target is to reach a FFR of 5.6% (aka, a range of 5.5% to 5.75%) by the end of this year. So, with four meetings remaining, you can do the math.

Thereafter, the dot plot suggests rates will stay elevated for an additional 12 to 18 months, but there are some caveats.

Firstly, real time inflation (constructed by several different indices and research houses) indicates that inflation is already significantly closer to the Fed’s 2% target (which is based on ‘rear-view mirror’ inflation).

Secondly, if stubborn inflation really is in shelter which is coming down (and not in wages which would make it a lot stickier) and if the Fed does continue higher for as long as it is predicting, it will overtighten.

While the Fed is giving way, it feels like we will see more investors go to cash (money market as opposed to bank deposits), more wobbles in the regional banking sector as net interest margins are crimped and lending slows, and a further narrowing of equities interest to AI and some green transition beneficiaries.

Our equities market and dollar here in Straya are likely to become weaker unless the RBA gets serious. We’re already seeing that weakening. The RBA has been hobbled (for credibility reasons) and is fundamentally ineffective.

It if cannot get inflation under control, I wonder if we see it wading into the FX market to directly prop up the AUD?

See you in the money market.

Mike

Next Level Corporate Advisory is a leading Australian M&A, capital and corporate development advisor with a dealmaking track record spanning three decades. We help family, private and publicly owned companies build and realise value in their businesses, assets and investments.

All written content is copyright NextLevelCorporate.