Pre-COVID-19 vs. Today, Part 4: The Macro Kangaroo

Image: Darren Patterson

A Vision Splendid

So far in my series, ‘Pre-COVID-19 vs. Today,’ we’ve covered three key macro forces, namely:

Part 1: US dollar dominance

Part 2: Equities

Part 3: Commodities

They are all very relevant to Australian businesses and investors.

But today, in my fourth and final instalment, I’m going to cover, Australia.

And to keep it manageable I’m going to utilise snapshot comparisons from the RBA. You’ll also note that the comps aren’t all up to the minute, and that’s because the RBA’s data is famously lagged 😁

So, let’s dig in to see how Clancy’s sunlit plains have changed since that pesky little bug came to our shores.

Inflation, has probably rolled over

Inflation hit 7.8% in December 2022, but was lower in June, weighing in at 6%.

Effect: In an attempt to try and stick the inflationary toothpaste back in the tube, the RBA like many other central banks raised interest rates which we talk about below.

Interest rates, higher for longer

We are now 335 basis points above where we were before COVID, and the RBA appears to be on pause albeit futures appear to be pricing in another hike.

Effect: Money costs more and is less available. Banks are doing well out of the net interest margin. Some savers are moving money out of equities into cash money market account and floating rate bonds. A section of variable rate and end of fixed term mortgage holders are doing it tough, with a $500k mortgage now costing $1,000 a month more. Our rates are well below those in the U.S., and we are sporting a negative real yield carry trade between our two countries making Aussie investment unattractive.

Real growth has gone backwards

At the same time as the cost of money has gone up, real growth, which was -0.7% pre-COVID, fell even further to -3.7% in June this year.

Effect: We’ve gone backwards and we’re still not out of the woods.

Wages have not kept up with inflation, not by a country mile

When we compare the below wage growth to the GDP growth metrics above, we see that while wage growth has kept up with GDP growth, it has not kept up with inflation. Recently, real wage growth was negative at a rate of -2.3%.

Effect: Household disposable incomes weaker.

Jobs have been growing, supporting higher rates for longer

Jobs growing faster and unemployment lower now, in contrast to pre-COVID days.

Effect: Like in most other countries, historically low unemployment prints are the favoured breakfast of central bankers, to justify higher interest rates for longer.

Piggy banks are emptying now the COVID-largesse has run out

Given higher cost of money and negative real wage growth (despite low unemployment), it will come as no surprise that the household savings rate has been barbequed post-COVID, by 60%!

Effect: Retail down with plenty for lease signs in malls, more jet skis for sale at lower prices, double whammy for cafes and restaurants, EV sales dropping with cheaper Chinese variants increasingly on the menu.

Houses cost 30% more since COVID

Average house prices have increased by nearly 30% since pre-COVID. That and the (un)affordability metrics already covered explain why less people are prepared to sell their homes and take on a new mortgage at higher interest rates to buy another home that will cost more.

Effect: Higher home prices for longer.

External buying power is weaker

The below metrics are out of date. The exchange is now US$0.637. Buying power has decreased by ~8%.

Effect: Stronger USD for longer has made commodities more expensive for non-U.S. sovereigns, and imports more expensive for Australian importers, since COVID. Add to that higher import prices from transportation costs and inflation.

Mining is the only key sector that has grown in output, post-COVID

This one is self-explanatory.

Effect: 40% increase in mining industry output, as a share of total key industry output.

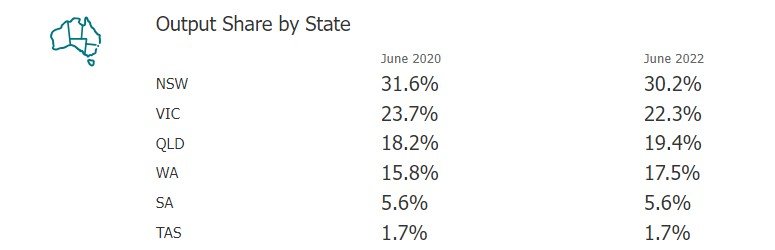

Which State or Territory leads?

So, it should also come as no surprise that the natural resource endowed states of WA, SA and Queensland lead the way.

Effect: Mining is carrying the national accounts.

Where do our resources go?

We crack, stack, compress and sail them to China, and increasingly Japan, Korea and India. You might also recall that Woodside punted a couple of LNG shipments to the Germans after Russia invaded Ukraine. Plus, our relationship with China has never been the same since ex-PM Scott Morrison decided to drop us into a never-ending trade war by upsetting China over where COVID came from.

Effect: Australia has been forced to diversify its export customer base. Other sovereigns are reshoring supply chains. How Australia plays its next sovereign cards (which are slightly limited due to the transportation/geopolitical imposts) will be extremely important as the country seeks to replace more China exports with demand from sovereigns that are more politically aligned.

Summary

Australia has experienced several significant economic changes since before COVID-19 and up to today.

While the pandemic initially caused a recession; stimulus measures, a commodity price boom (before prices came off) and digital transformations have played their roles in the country's ongoing recovery.

But we’re caught in a global macro-driven cycle, and not quite there yet.

Inflation is way too high, and that plus other unaffordability factors as well as China’s peaked economy and geo-political skirmishes are limiting a fulsome recovery and the next commodities super cycle.

That said, even at these prices, mining is carrying the economy and once we see a policy change in U.S. interest rates and a weaker USD, we should see more sunlight on our red dirt plains.

As for our more structural issues? Well, we have an ageing population, a hyper-reliance on China, and we remain exposed to a high USD and a floor under the oil price as OPEC continues its production/supply cuts and Putin plays out his game.

So, what do we need? That’s simple, a government that can properly calibrate monetary and fiscal policy to better respond to the global macro and new opportunities.

Do you know where we can find one?

I hope you have enjoyed this four-part series and if you’d like to discuss any of the topics covered, as ever, feel free to reach out.

Until then, see you in the market.

Mike

Image: Valeriia Miller

Next Level Corporate Advisory is a leading Australian M&A, capital and corporate development advisor with a dealmaking track record spanning three decades. We help family, private and publicly owned companies build and realise value in their businesses, assets and investments.

All written content is copyright NextLevelCorporate.