Pre-COVID-19 vs. Today, Part 2: Global Equities

Image: Tima Miroshnichenko

Snapshot to Part 2

The COVID-19 pandemic has had a profound impact on global economies, financial markets, and investor sentiment.

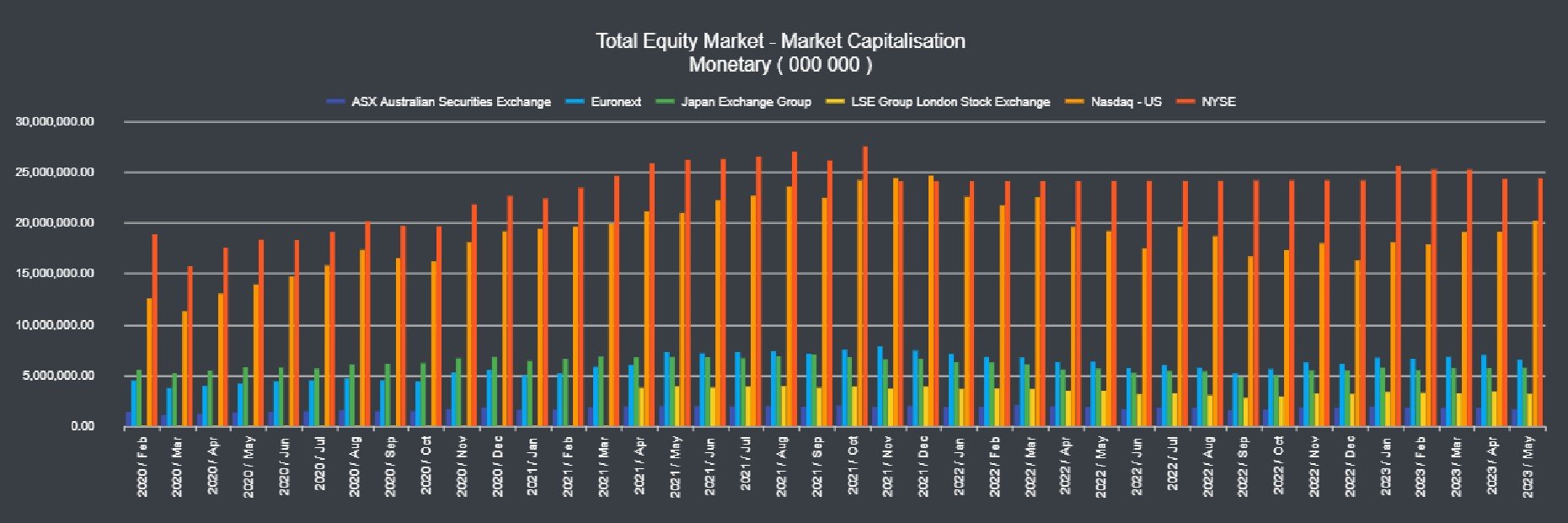

One of the world’s largest financial markets is the global equities market. Today, global equities are capitalised at around $101 trillion, whereas prior to COVID-19 they had a combined value of between $80 trillion to $90 trillion.

Why?

* World Federation of Exchanges

In this blog, we will examine and compare the sentiments, perceptions, and valuations surrounding equities before the pandemic and contrast them with the current outlook.

We will also explore changing investment themes, the passive versus active investment debate, volume and flows, algorithmic trading, concentration, the performance of indices, and we will also try to define what has fuelled the ~25% growth in the value of global equities since the pandemic.

This is the second piece in my new series “Pre-COVID-19 vs. Today” that I’ll be writing over the course of July.

I hope you enjoy the series.

Sentiments and perceptions:

Pre-COVID-19: Prior to the pandemic, investor sentiment towards equities was generally positive. A long bull market, low-interest rates, and robust economic growth contributed to a favourable outlook and a global asset class worth ~$80 trillion to $90 trillion. Many investors were optimistic, expecting equities to continue delivering solid returns.

Today: The pandemic has brought about a significant shift in investor sentiment. Uncertainty and market volatility have increased. Concerns about inflation, geopolitical tensions, recession and banking sector concentration and instability persist, tempering overall sentiment. Despite these challenges, sentiment towards equities is stronger than before the pandemic as not only have investors moved past it, but they have (rightly or wrongly) looked through this current monetary tightening period to a looser environment, on the other side.

Valuations and investment themes:

Pre-COVID-19: Before the pandemic, valuations in equities were relatively high based on weakening growth and calls for deflation. Traditional valuation metrics such as price-to-earnings ratios indicated potential overvaluation in certain sectors. Cyclical themes, such as technology, healthcare, and consumer discretionary, were popular among investors.

Today: Whilst valuations have become more nuanced post-pandemic with many of the work from home, home building and similar stocks having run out of steam, some sectors such as technology, healthcare and certain commodities have thrived due to changing consumer and worker behaviours, war in Europe and the release of ChatGPT. Investors are now focused on secular investment themes such as AI, digital transformation, sustainable energy and critical mineral as well as healthcare innovation.

Passive versus Active investment:

Pre-COVID-19: Passive investing through exchange-traded funds (ETFs) gained popularity, with investors seeking broad market exposure and lower costs. The trend towards index investing was strong, reflecting confidence in the long-term performance of equities with no reason to adopt an active approach.

Today: Passive investing remains popular, but there has been a resurgence of interest in active management. Volatility, war, market dislocations, constrained supply chains and geopolitical reshoring initiatives have created opportunities for active managers to generate alpha. Additionally, some investors seek targeted exposure to specific sectors or themes through active strategies, which is consistent with a market dynamic which rewards investors that are invested in a narrow range of sectors and sub-sectors.

Volume, flows, and algorithmic trading:

Pre-COVID-19: Equity trading volumes were steadily increasing, driven by a combination of institutional investors, retail traders, and high-frequency algorithmic trading. Market liquidity was generally robust, and algorithmic trading strategies were widely employed.

Today: Trading volumes remain elevated and major indices have shown resilience despite market volatility and the withdrawal of liquidity by central bankers, with technology continuing to play a crucial role. However, retail participation (led by lower volumes in crypto) have been evident other than for a narrow runway of technology stocks. The rise of retail traders and social media-driven investment trends fuelled by pandemic lockdowns has led to heightened volatility and sporadic spikes in certain stocks. Short squeezing assets through fintech platform accessible option strategies has never been easier. Regulators are also closely monitoring the impact of algorithmic trading on market stability.

Market expectations for future earnings growth:

Pre-COVID-19: In February 2020, the PE ratio (which is a valuation metric that compares the price of a company's stock to its earnings per share and provides insight into the market's expectations for a company's future earnings growth) was around 19x, as represented by the S&P 500 index. This indicates that investors were willing to pay approximately 19 times the earnings of the index's constituent companies for those stocks.

Today: The PE ratio is now higher, and trading at 21 times index earnings, indicating that investors are more optimistic about earnings growth than they were prior to COVID lockdowns and stimulus cheques. And that is significant because since that time we have had rolling lockdowns, ~6.9 million deaths as a result of COVID-19, war in Europe, banks failures in the U.S. and Europe, supply chain damage, a withdrawal of liquidity, escalating geopolitical tensions and trade wars. However, with bond prices decimated as interest rates have been moving up, there have been very few alternatives asset classes to invest in other than for equities and money markets.

Index performance across countries:

Pre-COVID-19: Major indices, such as the S&P 500, Dow Jones Industrial Average, and FTSE 100, were reaching record highs, propelled by large-cap technology companies. NASDAQ, the ASX, European and Japanese market indexes were all performing well. However, China had started to trend sideways by December 2018 when Huawei CFO Meng Wanzhou was extradited from Canada to the U.S. on charges of bank and wire fraud, and the Politburo had started to extract tributes from billionaires.

Today: Despite the challenges brought about by the pandemic, interest rate changes, war and shifts in stock market dynamics, indices have displayed resilience. These indices reflect the fluctuations experienced by different stock markets during the pandemic, including lockdowns, stimulus measures, vaccine announcements, recovery efforts, geopolitical events, and shifts in consumer, worker and investor sentiment. While setbacks have occurred, most stock markets have demonstrated strength, with NASDAQ clearly in the lead and with all but one index surpassing their pre-pandemic levels. The only exception is Hong Kong, which has faced challenges due to geopolitical factors and regulatory changes imposed by China.

All indexes other than for Hong Kong (HSI) are above their pre-pandemic lockdown levels.

Market concentration risk:

Pre-COVID-19: Market concentration was a growing concern, as a handful of stocks exerted significant influence on index performance, predominantly the FAANGs (facebook, amazon, Apple, Netflix and Alphabet/google).

Today: While the technology sector continues to play a vital role in driving market performance, equity investors have so far ignored concentration risks, threat of recession and the Fed’s calls for higher rates for longer. Instead, they have narrowed their gaze to AI beneficiaries (Microsoft, Nvidia, etc), safe haven large technology companies with cash, and certain post-pandemic services companies. In the past few weeks, we have started to see a slight broadening out of technology, however it is still too early to tell whether this is a anything more than an extension to bear market AI rally.

Conclusion

The COVID-19 pandemic, along with global stimulus and monetary policy measures as well as the rise of Robinhood and inclusive fintechs has significantly boosted global equity markets while diverting interest away from bonds.

There is an ongoing debate between passive and active investment approaches, with the latter gaining more favour today.

Despite concerns such as tighter monetary policy, geopolitical tensions, and inflation, equity trading volumes and valuations remain elevated, with major indices surpassing pre-pandemic levels.

Specifically, the assets class has grown by ~25% to around $101 trillion today, and the S&P500 index is trading on a PE multiple of 21 times today, versus 19 times prior to the pandemic.

This is due to the rotation of investment funds out of bonds and into equities as a result of rising interest rates and inflation pressures.

Put another way, bond prices have been decimated as interest rates have moved higher in an effort by central banks to choke off demand and inflation; and aside from money market accounts (more recently) there have been very few asset classes to invest in other than for equities.

However, the concentration of valuations in AI and technology stocks raises the question of whether the equities rally will broaden across sectors (a new bull market?) or face a correction (a bear market rally for longer?).

Stay tuned for market developments.

Mike

PS: “Pre-COVID-19 vs. Today” will return next Wednesday when we’ll look at energy, precious metal and agricultural commodities, then and now.

Next Level Corporate Advisory is a leading Australian M&A, capital and corporate development advisor with a dealmaking track record spanning three decades. We help family, private and publicly owned companies build and realise value in their businesses, assets and investments.

All written content is copyright NextLevelCorporate.