Metals Roundup Jan'26: January 2026 when all the bulls came out to party

“They had forgotten how to party” Copyright, nextlevelcorporate, 2026.

TL; DR

Well, aside from the equities and crypto blood bath on the second last day of the month, January was the month when the bulks, base, precious metals and ag bulls all came out to play at the same time.

This was the rarest of scenarios. Partially the result of a weaker USD and the geopolitical storm whipped up by you know who, but I don’t think it will be lost on many of you that the suds party the bulls were enjoying was largely poured from a keg of extreme risk-on sentiment.

Then on 30 January, the Fed left rates were on pause, December PPE surprised many people who didn’t believe inflation comes in waves, and Donald Trump announced Kevin Warsh as his Fed Chair nominee.

Markets (over)reacted violently, belting down prices and the bloodbath doubled down four days later after Anthropic announced its AI legal/professional services plug-in, signalling AI’s existential threat to cloud software was no longer existential.

More detail on the above is available in last week’s article: “Why interest rate cuts are harder this time,” but for today let’s break down January’s remarkable industrial metal price accelerations.

Your Charts for January 2026

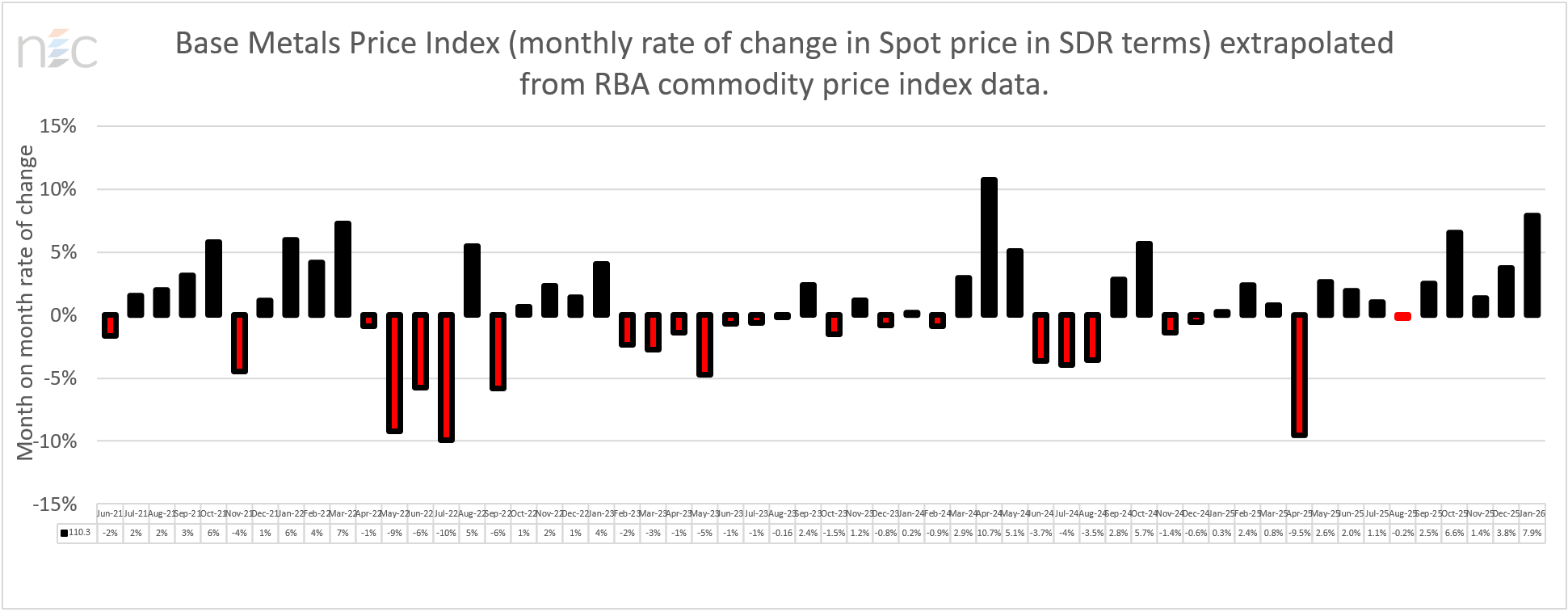

🔗🏮🔌 Base Metals on a tear

Month on month, the base metals index grew at 7.9% in January, more than twice as fast as December’s 3.8% rate of change, which in turn was more than double the 1.4% acceleration in November.

In short, the second derivative tells us that base metal prices have been accelerating faster each month, for the past three months. And it’s the second fastest rate of change in 4.5 years.

We’re starting to get confirmation of inflationary forces in metals used in manufacturing and energy transition.

The U.S. in particular is seeking to tap Australia for gallium, heavy rare earths, lithium and other minerals. It’s committing significant billions (as is our Federal Government) to ensure chips, compute, energy and strategic minerals security.

For a breakdown on the above demand drivers of price, read our article “The next growth engine.......Geopolitics, Strategy, and Investment.”

Copyright, NextLevelCorporate Advisory

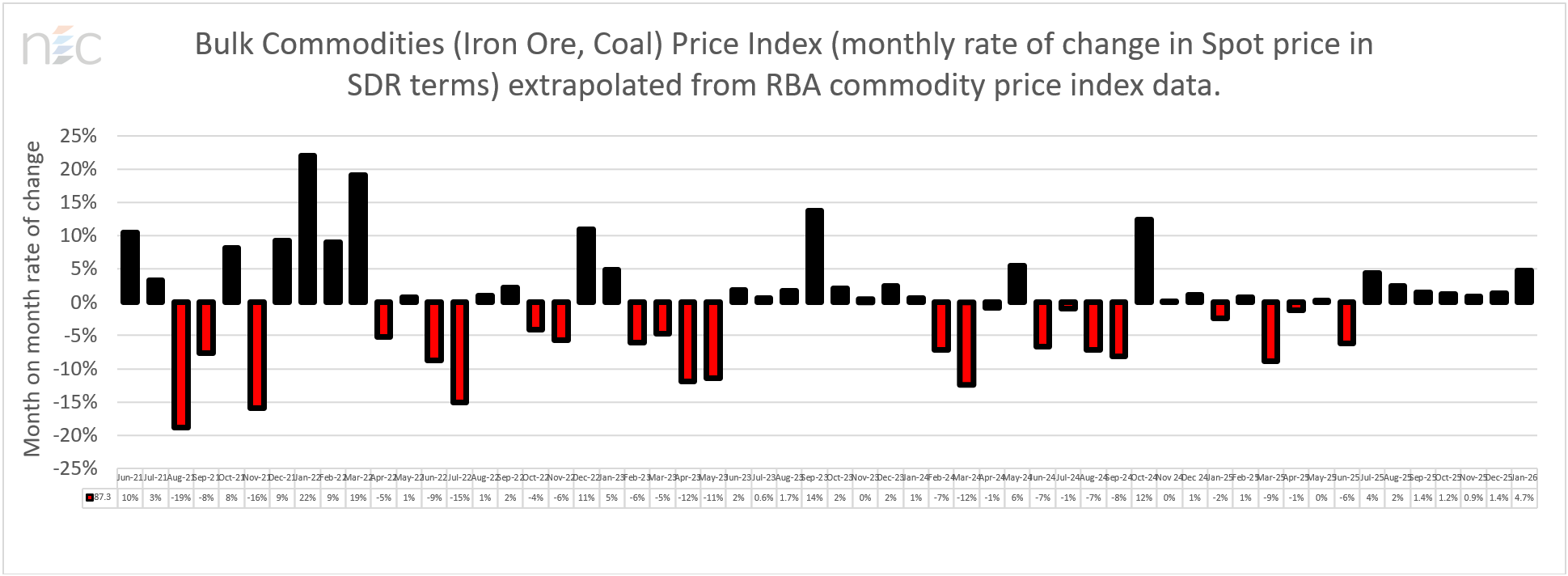

🧱👷♀️🌉 Bulk minerals

Growing, faster each month, with positive bulk price increases in December and January, accelerating markedly.

January’s rate of change of 4.7% is the highest acceleration since May 2024, and before that, September 2023.

This print marks the seventh month of accelerating prices.

Copyright, NextLevelCorporate Advisory

⚗🧲☢ Energy minerals (ex-coal and oil)

The July 6, 2023, price high for LME Lithium Hydroxide CIF was US$46,046.

On the last LME trading day of January, it printed US$18,180/t, a remarkable improvement, nearly double the price from two months earlier, but still more than 60% down from its July 2023 peak.

Uranium peaked at US$99/lb, after a massive acceleration following its reinstatement as a critical mineral in the U.S. However, since the end of the month, the spot price has fallen back to US$85/lb as energy-hungry tech recipients have rerated.

Fossil fuels are making a structural comeback as I’ve been suggesting. This is predominantly due to demand from data centre formation and the requirement to exploit every available calorific unit, particularly as supplies of Russian, Venezuelan and Iranian oil vacillate. Trump’s deal with India is likely to take Russian barrels off the menu, well at least that’s the plan, and that could lead to positive earnings for big oil and oilfield services companies.

Local impact

As I mentioned last month and in the months before, we’re still seeing cyclical dollar weakness, which may or may not be enough to kick start a new commodities super cycle. My hesitation is that while the USD has cyclically weakened, global liquidity has been draining, and sustained demand from China is yet to be confirmed.

Implications for your corporate development strategy: Higher rates for longer in the U.S. and Australia are assured for at least the foreseeable future given inflationary pressures and strong jobs formation making it harder to justify rate cuts. Greenfield projects other than for precious metals and government subsidised/supported strategic minerals are unlikely to occur until the tide changes once inflation has been brought under control. In its place, there will be more M&A rather than greenfield developments. This should accelerate in 2026. Capital raising will be selective, but in some cases monstrous, given the rotation out of software — deployed money has to go somewhere— so why not into materials that are supporting chips, electronics, data centres, drone and joint strike fighters.

Implications for your personal investment strategy: We’ve been experiencing a level of USD weakness. However, global liquidity has been draining not building, for the moment. Precious metals have come off since 30 January and shortly may represent solid buying opportunities. Defence, critical minerals, compute and energy transition thematics remain solid. Ignore these at your own peril. And since GDP growth can’t keep up with debt growth, the secular uptrends in precious metal prices remain in place, regardless of cyclical corrections/consolidations. Be careful with software, because there’s a pretty good reason they’ve been sold down, and it’s nothing to do with Kevin Warsh and liquidity.

Overall, the full effects of 30 January are yet to be seen and there’s likely to be more air pockets before we join the bulls’ party—but what a party it will be.

See you in the market 🖐

Mike

With decades of success across six continents, NextLevelCorporate expertly navigates the intersection of M&A, financial advisory, and business strategy—delivering macroeconomically aligned corporate development strategies, with bespoke transactions that bring them to life.

All content is copyright NextLevelCorporate. NextLevelCorporate and logo are registered trademarks.