13 years of Australian disinflation - Hello?

In Australia, for there to be a different trajectory for interest rates, the RBA says it wants to see almost full employment.

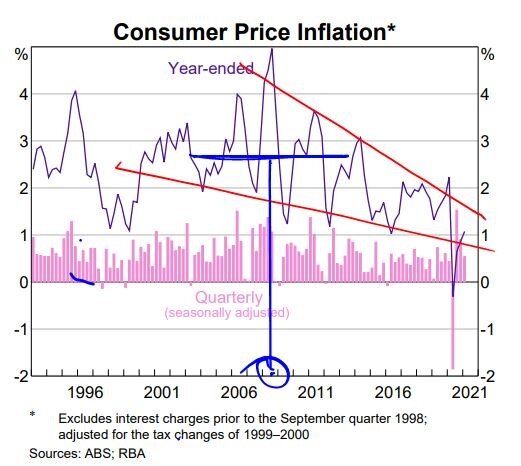

It also wants consumer price inflation comfortably within the 2% to 3% target range, for some time.

Problem is the last time we spotted a 2% to 3% average CPI trend was before the GFC - around 13 years ago. Hello?

Since then, massive monetary debasement globally, plus 0% rates leading to less disposable income for risk averse retirees, plus the Amazon effect on prices, and an ageing population have kept it in check.

And, aside from some breakthrough price increases as supply chains and rolling lockdowns recalibrate, the flation compass is still pointing east-southeast as per the red lines below.

Still looking for that uptrend (lines added by NLC).

On top of that, it’s a mystery as to where step-change growth and productivity will come from to solve underemployment and keep the population fully employed.

In terms of productivity and output, the mining industry has seen the most growth (see the black line in the chart below).

Yes, mining is a massive GDP/export earner (iron ore and coal to be exact), but it’s a comparatively small employer of people.

The construction/maintenance and business services industries are massive employers, but they have been reasonably flat. Although more recently in WA, construction and other blue collar roles have been subject to skills shortages and crazy high wages/labour rates, so there is already major wage push there. But that’s just one pocket.

Most other industry output is flat or down.

Oh, and just like the U.S., Europe and Japan, here in Australia we have an ageing retiree population that’s earning less (bonds have cratered) and spending less.

So, to reverse this disinflationary trend in Australia, Canberra needs to get serious about doing some heavy lifting and fixing the Fiscal in a way that is accessible to all sections of the population, so that new industries and communities can thrive - and spend!

And as Industry 4.0 continues to knock on Australia’s door like a persistent Kramer looking for crackers, what a great time to incentivise its development.

Keep safe everyone.

Mike.

Next Level Corporate Advisory is a leading M&A and capital markets advisory with a multi-decade track record of delivering high quality independent financial advice and strategic transactions.

All text in this article is copyright NextLevelCorporate.